All eyes will be on the UK and the possible implications for the markets as parliament votes on whether to accept the withdrawal agreement for Brexit this week, writes Ian Slattery.

Ian Slattery

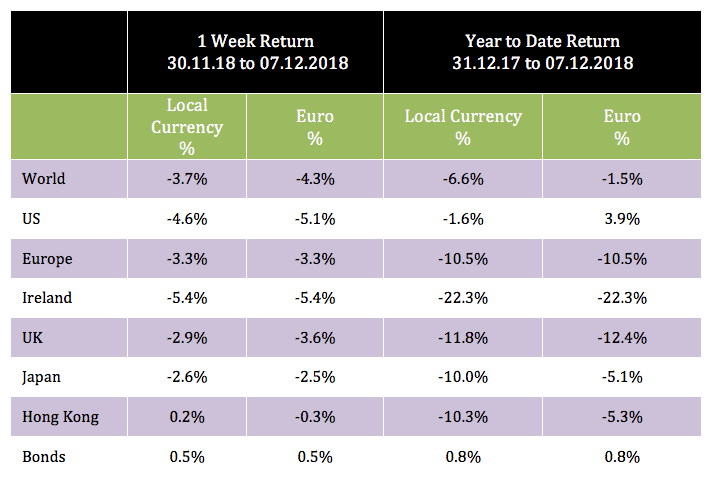

The CBOE Volatility Index (VIX) rose and global equities erased last week’s gains, with technology shares in the US suffering. In Europe, the automotive-heavy German market entered a bear market – down over 20% since the beginning of the year.

Investors fretted that part of the yield curve inverted, signalling economic strain. To put things in perspective though, the 3-month/10-year rate spread only breached 0.5% for the fourth time since 1992. On the previous three occasions, the market generated a positive return the following year.

Economic data also remains broadly positive. In the U.S., the unemployment rate of 3.7% represents a 49-year low, while the gauges for both manufacturing and services increased and consumer sentiment came in higher than expected.

The global equity index declined 3.7%, erasing last week’s gains. U.S. small cap stocks weighed, with the tech and financial sectors weak.

Oil prices enjoyed some respite, advancing to $52.61 /barrel. OPEC and its partners have agreed to cut production in an attempt to stabilize the market. Gold moved higher to finish the week at $1,248 per troy ounce, while Copper declined to $6,149 on the back of economic growth concerns.

The sell-off in the equity markets also pushed the yield on the U.S. 10-year bond lower to 2.85% and the German equivalent to 0.25%.

The EUR/USD rate ended the week at 1.138, with the EUR/GBP at 0.894.

THE WEEK AHEAD

Tuesday 11th December:

In the UK, the labour market is expected to post a small gain to keep the unemployment rate at 4.1%. The UK parliament will also vote on whether to accept the withdrawal agreement and framework for the future relationship that the UK government has agreed with the EU.

Wednesday 12th December:

The sharp drop in gasoline prices in November (~8%) is expected to suppress the headline US CPI figure. Core CPI (ex-food and energy) is forecast to rise at a pace of 0.2% m-m, driven by ongoing momentum in the consumer space.

Friday 14th December:

Retail sales in the U.S. (ex. autos) are poised for a 0.7% rise m-m, driven by the 7.9% gain in same-store-sales recorded over the Thanksgiving weekend. The flash PMI released in Europe will give some indication as to the extent of the recovery from Q3’s GDP print of 0.2%.

The team at Zurich Investments is a long established and highly experienced team of investment managers who manage approximately €23.5bn in investments of which pension assets amount to €10.8bn. Find out more about Zurich Life’s funds and investments here.

w: zurichlife.ie/funds t: @ZurichLife

l: linkedin.com/company/zurich-life-assurance-plc