Equities take Fed tightening talk in their stride to move higher, writes Ian Slattery.

Ian Slattery

The dominate event during last week was the US Federal Reserve announcement that it was to begin reducing its massive bond portfolio, amassed since the financial crisis. The move had been well telegraphed, with the Fed reluctant to surprise markets. The world’s most influential central bank also lowered its inflation forecasts somewhat, but remained broadly positive on the outlook for both unemployment and economic growth.

It was a choppy, but positive, week overall for equity investors as US President Trump announced further sanctions against North Korea, whilst striking a less than conciliatory tone with his debut speech at the UN General Assembly. The North Korean authorities’ response has led to a further escalation of tensions in the region.

Global bonds had sold off on the more hawkish commentary from a number of central banks over the past fortnight, but found some support over the last seven days on the back of heightened geopolitical concerns.

The world’s most influential central bank also lowered its inflation forecasts somewhat, but remained broadly positive on the outlook

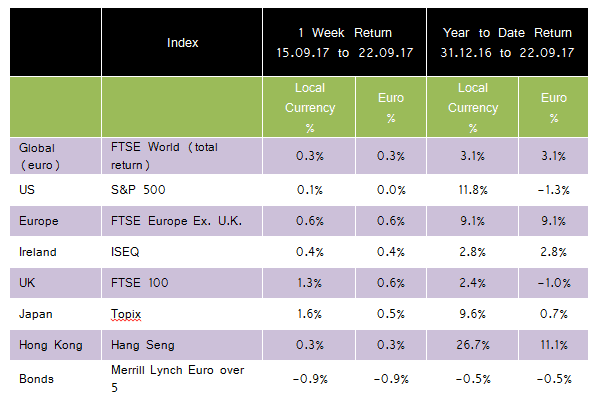

The global index moved higher last week, returning a positive 0.3%. Gold and copper both faltered, returning -1.7% and -0.2%, respectively.

Oil continued its recent upward trend, returning 1.5% whilst closing above $50 per barrel. The influential US 10-year bond yield moved to 2.25% from 2.20%, on the more hawkish sentiment from the Fed. The German equivalent stood at 0.45% from 0.43% a week ago.

The week ahead

Thursday 28th September

The consensus expects the final US GDP figures for Q2 to be confirmed at 3.0% (quarter-on-quarter).

Friday 29th September

- Eurozone “flash” inflation data for September goes to print where the market expects a figure of 1.6% (year-on-year), up slightly from an August reading of 1.5%.

- Final UK GDP figures for Q217 are also released, where the market forecasts no change from the previously released figure of 0.3% (quarter-on-quarter).

The team at Zurich Investments is a long-established and highly-experienced team of investment managers who manage approximately €21.5bn in investment assets and have a reputation for delivering consistent performance. To find out more about Zurich Life’s funds and investments, w: zurichlife.ie/funds t: @ZurichLife

l: linkedin.com/company/zurich-life-assurance-plc