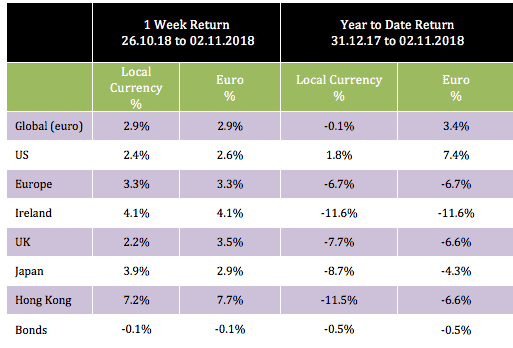

Equites rebounded and the global index was up almost 3% in euro terms last week. Ian Slattery reports.

Ian Slattery

Stocks rebounded strongly from oversold levels last week, as markets reacted positively to solid economic data and optimism over the potential for a US-China trade deal. Presidents Trump and Xi spoke on Thursday and all eyes are now on a face to face meeting later in the month.

Non-farm payrolls surprised to the upside on Friday, with 250,000 jobs created in October, easily surpassing the already lofty expectations of 200,000. Wage growth also rose above 3% for the first time since 2009.

Headline earnings were mixed, with Apple disappointing. However, the underlying figures for the market as a whole were positive, with US economic data also painting an optimistic picture. Within monetary policy, both the Bank of England and the Bank of Japan left interest rates unchanged.

The global index was up almost 3% in euro terms last week, led by eurozone and Asian stocks.

Oil moved lower once again, and closed at $63/barrel, as global supply side worries eased further. Gold closed higher at $1233 per troy ounce, and was relatively flat across the week. Copper finished the week at $6,319 per metric tonne, as it moved off recent lows.

The 10 year US bond yield finished at 3.21%, on the back of strong US wage growth data whilst the German equivalent also closed higher at 0.43. The EUR/USD rate was at 1.14.

THE WEEK AHEAD

Tuesday 6th November

The US mid-term elections take place, with results expected Wednesday. If the Democrats gain either the House or the Senate is may stymie President Trump’s agenda over the coming years.

Thursday 8th November

The Fed FOMC meets for their latest interest rate decision, where no change is expected. However, the proceedings will be closely watched for confirmation of the expected rate hike in December.

Friday 9th November

Chinese CPI data goes to print, where the consensus expects the latest figure to come in at 2.4% (YoY) from a previous reading of 2.5%.

[/highlight]

The team at Zurich Investments is a long established and highly experienced team of investment managers who manage approximately €23.5bn in investments of which pension assets amount to €10.8bn. Find out more about Zurich Life’s funds and investments here.

w: zurichlife.ie/funds t: @ZurichLife

l: linkedin.com/company/zurich-life-assurance-plc