Receding trade-war fears have allowed the likes of energy stocks to soar, including the price of oil reaching a four-year high, says Ian Slattery.

Ian Slattery

Receding trade-war fears help the S&P 500 Index return 2% for the week. Energy stocks surged, with the price of oil reaching a four-year high amid concerns over the US strike on Syria. Europe’s STOXX 50 Index (+1.2%) rallied for the third consecutive week.

Consumer sentiment in the US is still broadly positive as evidenced by the release last week of the University of Michigan’s sentiment index, with consumers remaining confident in April despite their unease over the potential economic impact of US trade policies.

Energy stocks surged, with the price of oil reaching a four-year high amid concerns over the US strike on Syria.

As earnings season in the US begins, analysts are predicting a positive boost from the recent corporate tax cuts. Overall, the consensus estimate for first-quarter earnings growth is 17.1% year-over-year bolstered by a solid global economy, healthy revenue growth, and higher cash flows stemming from December’s corporate tax cut.

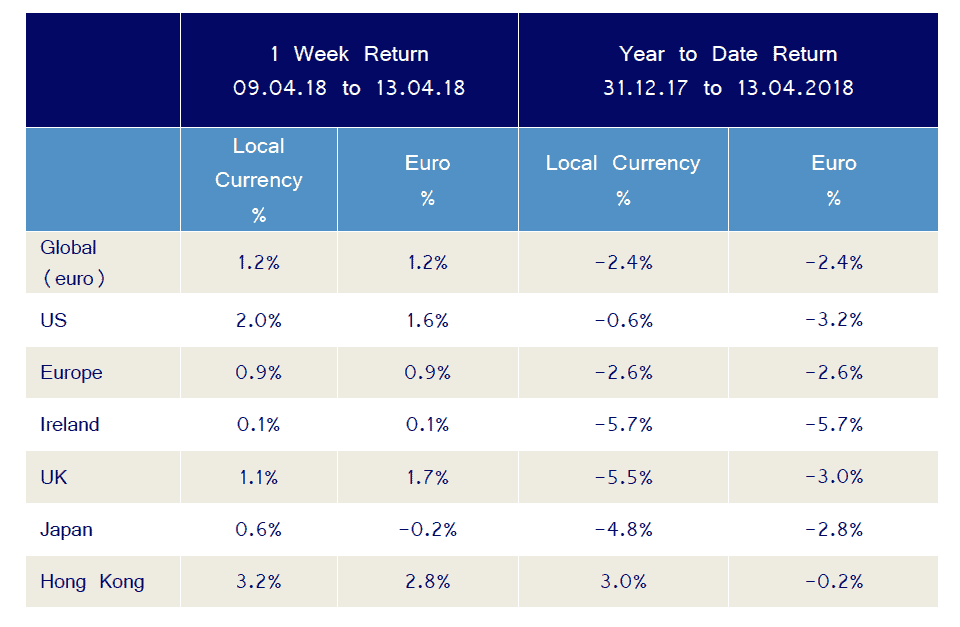

The global index rallied and was up a solid 1.2% for the week. This was led by positive US (+2%) and Hong Kong (+3.2%) markets. Europe also returned a positive 0.9% for the week.

Another key driver for the week was oil, rising sharply (+8.6%) on the back of concerns over US strikes on Syria.

Gold (+0.9%) and copper (+0.4%) also saw slight rises.

THE WEEK AHEAD

Tuesday 17 April

UK employment data for March forecast to be 4.4% in Febraury, up from 4.3% previously, while February average earnings (including bonus) rise 2.6%.

Wednesday 18 April

German ZEW index for April – economic sentiment to drop to 3.2 from 5.1.

Friday 20 April

Japan consumer price index (CPI) for March – forecast to be unchanged 1.5% year-on-year from 1.5%. Core CPI to be 1%, in line with last month.

The team at Zurich Investments is a long-established and highly-experienced team of investment managers who manage approximately €22.4bn in investment of which pension assets amount to €10.1bn. To find out more about Zurich Life’s funds and investments, w: zurichlife.ie/funds t: @ZurichLife

l: linkedin.com/company/zurich-life-assurance-plc