Overall, markets slipped last week as the virus infection rates remained stubbornly high, writes Ian Slattery.

Ian Slattery, Zurich Investments

Tech stocks outperformed the market as investors continued to buy companies that may benefit from continued social distancing and remote working. The NASDAQ index hit a number of all-time highs over the course of the week.

Economic data was broadly positive last week with PMI data in the U.S. and Europe continuing to improve and housing data from the U.S. also came in strong. However, virus data proved to be the most compelling narrative for markets, as much of the recently released data is thought to reflect conditions before the recent surge in U.S. cases. Last week, the U.S. crossed the threshold of 60,000 new cases in a single day, with over 3 million reported since the onset of the pandemic. Bond yields continued to fall across developed markets as the virus cases increased, with inflation expectations also remaining extremely muted. Within commodities, gold rose above the key psychological price level of $1,800 an ounce last week and hit its highest level since 2011.

In the U.K., the Chancellor of the Exchequer Rishi Sunak announced a support package of over £30bn, including a £5bn infrastructure spend a number of measures to stimulate the housing market. Earnings seasons comes back into focus once more this week, with the big U.S. banks all reporting their earnings numbers to the end of June.

Equities

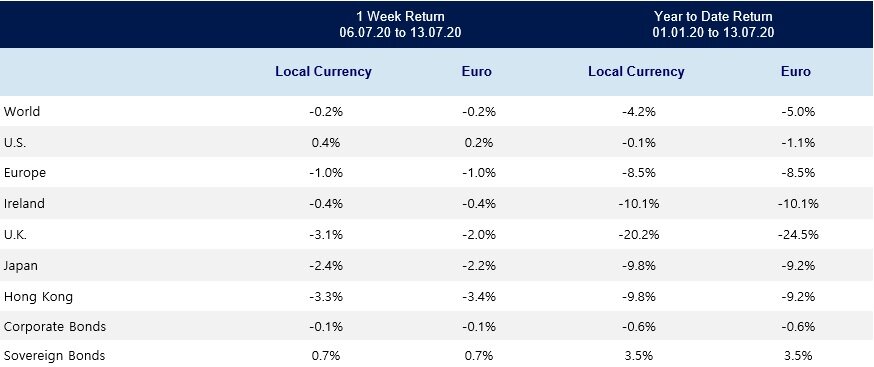

- Global markets moved down slightly last week, by -0.2% in both local and euro terms.

- The U.S. market was up slightly by 0.4% and 0.2% in local and euro terms respectively.

Fixed Income & FX

- The U.S. 10-year yield finished at 0.63% last week. The German equivalent finished at -0.45%. The Irish 10 year bond yield finished at -0.01%.

- The Euro/U.S. Dollar exchange rate remained at 1.13, whilst Euro/GBP finished at 0.89.

Commodities

- Oil finished the week at $40 per barrel.

- Gold finished the week at $1,807 per troy ounce up 19.1% year to date in local terms and 17.9% year to date in Euro terms.

- Copper finished the week at $6,419 per tonne.