Proposals in the US for a new corporate tax rate and plans to simplify the personal tax brackets, down to three from seven, saw the markets remain positive, writes Ian Slattery.

Ian Slattery

Tax reform took centre stage in the US as the administration announced proposals for a new corporate tax rate of 20%. There are also plans for a simplification of personal tax brackets, down to three from the current seven. Whilst it remains to be seen whether the plans come to fruition, the markets were positive on the announcements.

Fed Chair Janet Yellen also spoke in Cleveland last week, where she warned of moving too gradually on interest rates. This led the dollar higher as expectations of one more interest rate rise in the US continue to move higher.

Fed Chair Janet Yellen also spoke in Cleveland last week, where she warned of moving too gradually on interest rates.

The euro moved lower over the course of the week in the wake of the Germany’s election results. Whilst Angela Merkel secured her fourth term as Chancellor, she did so with a smaller majority than expected in an election which also saw the far-right AfD party exceed expectations with over 12% of the vote.

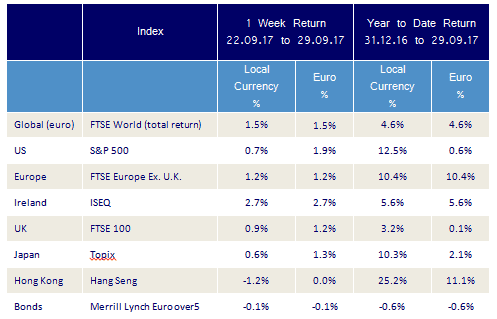

The global index moved higher again last week, returning a positive 1.5%.

Oil continued its recent upward trend, returning 2% and copper was also positive returning 0.4%.

Gold faltered last week returning -1.3%.

THE WEEK AHEAD

Monday 2nd October

Manufacturing PMI data from US is expected to fall sharply to 57.5 from 58.8 last month, mainly driven by the impact of Hurricanes Harvey and Irma.

Wednesday 4th October

US non-manufacturing PMI data for September is released, and is forecast broadly unchanged from last month (last: 55.3), with a continued positive expansion in line with economic growth.

Friday 6th October

US non-farm payroll data goes to print, where the consensus expects 88,000 jobs to be added, down from 156,000 a month previously.

The team at Zurich Investments is a long-established and highly-experienced team of investment managers who manage approximately €21.5bn in investment assets and have a reputation for delivering consistent performance. To find out more about Zurich Life’s funds and investments, w: zurichlife.ie/funds t: @ZurichLife

l: linkedin.com/company/zurich-life-assurance-plc