Ian Slattery reports that although consumer sentiment in the US dipped in November, this follows October’s 13-year high.

Ian Slattery

It was a light week of trading as the approaching Thanksgiving holiday in the US garnered attention, with trading volumes 20% below the monthly average. However, stocks on both sides of the Atlantic still moved higher, as the S&P 500 hit a fresh record high last Tuesday.

The latest Fed minutes did nothing to dissuade the market of the prospect of a December rate hike, although the slightly ‘dovish’ tone of some of the commentary led to a fall in the US dollar versus its peers, most notably the euro. The single currency was also supported by news from Germany that the risk of another election had dissipated somewhat.

Oil continued its recent positive run, up 4.2% and closing just short of $59/barrel.

Consumer sentiment in the US for November dipped slightly, however this follows October’s 13-year high. The Conference Board’s index of leading economic indicators increased sharply, suggesting the improved economic backdrop is set to continue.

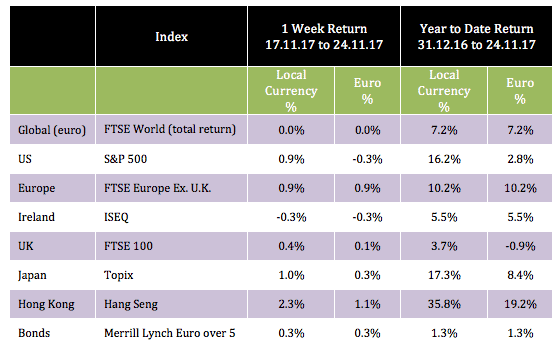

The global index in euro terms returned 0.02% last week, although the strengthening euro reduced returns for Irish investors. Hong Kong led the way, up 1.1% (in euro terms).

Oil continued its recent positive run, up 4.2% and closing just short of $59/barrel. The ten-year US bond yield closed the week at 2.34%, although the two-year yield has risen sharply in recent months. The German ten-year bond yield closed at 0.36%. The EUR/USD rate finished the period at 1.19, up from 1.17 a week ago.

THE WEEK AHEAD

Wednesday 29 November

The consensus view is for the second estimate of Q3 US GDP to come in at 3.2% (quarter-on-quarter).

Thursday 30 November

The flash eurozone inflation figures for November are released with the year-on-year figure projected to be 1.6%, up from 1.4%.

Thursday 30 November

Japanese inflation and unemployment data goes to print, with consumer price index (CPI) expected to rise to 0.8% from 0.7%, while unemployment looks set to remain at 2.8%.

The team at Zurich Investments is a long-established and highly-experienced team of investment managers who manage approximately €21.9bn in investment of which pension assets amount to €9.9bn. To find out more about Zurich Life’s funds and investments, w: zurichlife.ie/funds t: @ZurichLife

l: linkedin.com/company/zurich-life-assurance-plc