Stocks moved higher over the course of the week as investors were buoyed by the French election results, writes Ian Slattery.

Political concerns were alleviated as the outcome of the vote was widely as expected. European equities are seeing net inflows once again, following large outflows during 2016.

Ian Slattery

US GDP data disappointed, as the world’s largest economy grew by a rate of only 0.7% for the first quarter.

Markets however, took this in their stride and the VIX, the volatility index seen as a measure of fear on Wall Street, fell 9% to its lowest level since February 2007.

The US administration announced tentative plans in respect of tax reform, but the market is likely to wait for further details.

On the earnings front, just more than half of the S&P 500 have reported for Q1. Roughly 70% have beaten expectations in relation to the bottom line, with industrials and tech the best performing sectors.

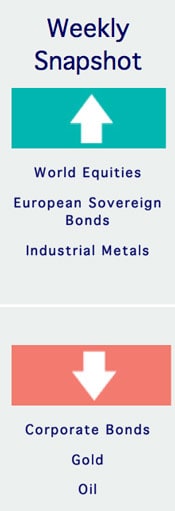

The global index finished the week up 0.2%, led by a strong performance from Europe (+3.1%).

The global index finished the week up 0.2%, led by a strong performance from Europe (+3.1%).

Gold slipped by over 1% as a more ‘risk-on’ sentiment prevailed in the market.

Oil was down also, as US shale producers continued to ramp up supply.

US GDP data disappointed, as the world’s largest economy grew by a rate of only 0.7% for the first quarter

The US ten-year treasury yield was little changed on the week, finishing at 2.28% from 2.25%.

The equivalent German yield moved from 0.25% to 0.32% as prices, which move inversely to yields, fell in the wake of the French election result.

The euro/USD rate closed at 1.09, from 1.07 a week ago.

The US administration announced tentative plans in respect of tax reform, but the market is likely to wait for further details

THE WEEK AHEAD

Wednesday May 3rd

No interest rate change is expected when the Fed’s FOMC meets, although there may be some guidance on the likelihood of a June hike. Eurozone GDP data is also released, and is expected to tick up to 0.5% from 0.4% (quarter-on-quarter).

Friday May 5th

US non-farm payroll data for April goes to print. The consensus expectation is for a job creation figure of 193,000; up from 98,000 in the last reading.

Sunday May 7th

Emmanuel Macron and Marine Le Pen will face off in the second round of the French Presidential election. Markets expect the centre-right Macron to win, as he currently has a double-digit lead in the polls.

The team at Zurich Investments is a long established and highly experienced team of investment managers who manage approximately €21.6bn in investment of which pension assets amount to €9.6bn. To find out more about Zurich Life’s funds and investments, w: zurichlife.ie/funds, Twitter: @ZurichLife, LinkedIn: linkedin.com/company/zurich-life-assurance-plc