Risk assets move higher on global growth optimism, writes Ian Slattery.

Ian Slattery

Equity markets moved forward over the course of the week, with strong economic fundamentals taking centre stage. Data in Europe continued to expand and economically sensitive stock sectors did better than those with a more defensive orientation, as oil also moved forward on the back of global growth optimism.

The minutes from the January Fed meeting were released and conveyed confidence in the US economy, with a rate rise in March looking increasingly likely on the back of firm global growth and a better than expected boost from US tax cuts.

Earnings season is drawing to a close, and with 87% of companies on the S&P 500 having now reported, over three quarters have beaten profit expectations.

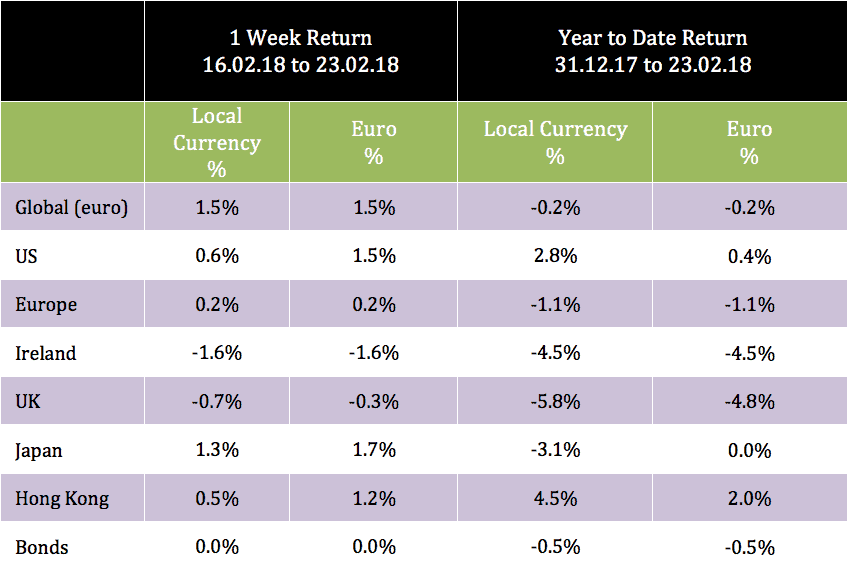

The global index rose by nearly 1.5% in euro terms for the week, with Asia leading the way with Japan one of the best performing of the major markets, up 1.3% in local terms.

Oil moved higher last week, and closed back above $63/barrel, helped by optimism on global growth. Copper fell 1%, on the back of a 7% upward movement the week before and gold lost 1.4% but remains up 2% in 2018 in dollar terms.

The 10 year US bond yield finished the week at 2.87%, roughly were it finished the week before, the German equivalent was at 0.65%, from 0.70%.

The EUR/USD rate closed the period at 1.24, from 1.07 a year ago. The EUR/GBP was at 0.88.

The week ahead

Flash eurozone inflation figures for February are released, with the headline number expected to rise to 1.3% from 1.2% (year-on-year), with the core figure forecast to hold steady at 1.0%.

Fed Chair Jerome Powell testifies in front of the US Congress, which will be his first public appearance since taking office.

Sunday 4th March

Italy goes to the polls this weekend, in a hotly contested general election which currently has no clear winner according to polls.

About: Zurich Investments

The team at Zurich Investments is a long established and highly experienced team of investment managers who manage approximately €22.4bn in investments of which pension assets amount to €10.1bn. Find out more about Zurich Life’s funds and investments here.

The team at Zurich Investments is a long established and highly experienced team of investment managers who manage approximately €22.4bn in investment of which pension assets amount to €10.1bn. To find out more about Zurich Life’s funds and investments, w: zurichlife.ie/funds, Twitter: @ZurichLife

LinkedIn: linkedin.com/company/zurich-life-assurance-plc

Warning: Past performance is not a reliable guide to future performance. Benefits may be affected by changes in currency exchange rates. The value of your investment may go down as well as up. If you invest in these funds you may lose some or all of the money you invest