Equities fell as risk adverse sentiment prevailed, writes Ian Slattery, with geopolitical the main contributing factor.

Equity markets fell as volatility returned this week, sending the VIX or ‘Fear Index’ to its highest level since the US election in November.

Ian Slattery

Uncertainty over US policy implementation, caution ahead of the Q1 earnings season, and the upcoming French election all contributed to a more prudent stance from investors.

Geopolitical concerns were also present, as US relations with Russia, Syria and most notably North Korea were all in the spotlight.

Comments from President Trump also influenced US dollar trading, as he expressed his views on its current ‘overvalued’ state. Gold also traded higher as ‘risk-off’ sentiment became prevalent in the market. However, oil continued its recent rally on the back of positive OPEC comments and falling Libyan production.

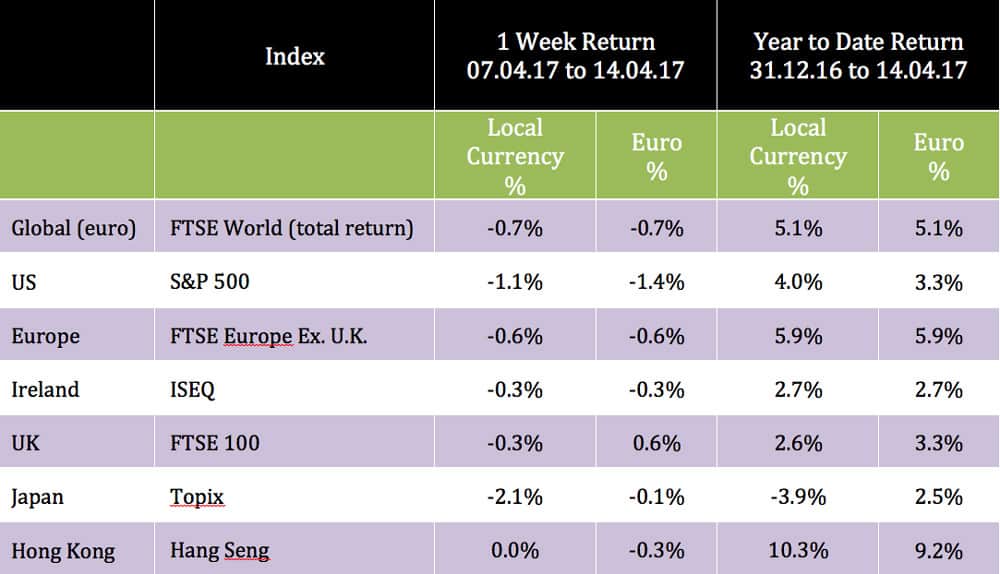

The global index finished the week down 0.7%, shaving gains for the year to just over 5%.

Gold extended its gain year-to-date to 11.6% after a weekly gain of 2.5%. Silver and Oil were also up 2.9% and 1.8% respectively over the course of the week.

Volatility returned this week, sending the VIX or ‘Fear Index’ to its highest level since the US election in November

US 10-year bond yields fell last week to now stand at 2.24%.

The equivalent German yield fell slightly from 0.23% to 0.19%. The euro/US dollar rate ended the week at 1.06, whilst euro/sterling closed at 0.86.

Vintage image created by Jcomp – Freepik.com

THE WEEK AHEAD

Tuesday April 18th-Friday April 21st

Earnings continue to come in throughout the week, with highlights including figures from Goldman Sachs, General Electric and Johnson & Johnson.

Wednesday April 19th

Eurozone headline inflation for March is widely expected to be confirmed at 1.5% (year-on-year) with 0.7% (year-on-year) expected for the core figure.

Friday April 21st

Flash PMI data for the eurozone is released where markets will look for a continuation of the recent strong data.

The team at Zurich Investments is a long established and highly experienced team of investment managers who manage approximately €20.8bn in investment of which pension assets amount to €9.9bn. To find out more about Zurich Life’s funds and investments, w: zurichlife.ie/funds, Twitter: @ZurichLife, LinkedIn: linkedin.com/company/zurich-life-assurance-plc