In his weekly round-up of the markets, Ian Slattery reports that stocks recorded record highs again last week, as better-than-expected results drove equities higher.

Ian Slattery

Earnings helped stocks move to record highs once more last week, as better-than-expected results, led by financials, healthcare and industrial, drove equities higher. The bulk of earnings are still to come in over the next few weeks with tech stocks dominating the reporting for the week ahead.

Global sovereign yields (which move inversely to price) moved higher throughout the week on the back of positive global Purchasing Managers’ Index (PMI) data, which was led by accelerating expansion in Europe. Less dovish than expected comments from the European Central Bank (ECB) also weighed on longer data bond yields. Currencies saw a choppy week of trading with numerous comments on both sides of the Atlantic influencing the key Euro/USD currency pair. The trade weighted dollar index is now at levels last seen in mid-2015.

Global sovereign yields (which move inversely to price) moved higher throughout the week on the back of positive global PMI data, which was led by accelerating expansion in Europe.

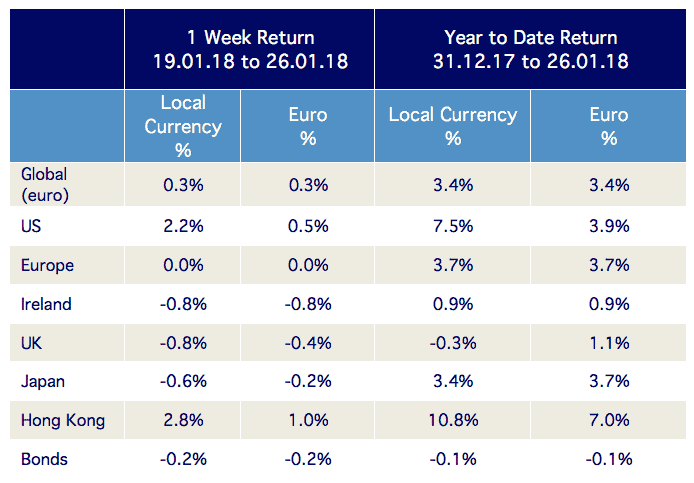

The global index in euro terms was up 0.4% last week, and has now gained 3.4% year-to-date. Asia Pacific equities continued their strong start, with Hong Kong now up 10.8% in 2018 in local terms.

Oil moved higher last week, up over 4% and is now trading at above $66/barrel. Copper moved higher also, but remains down over 3% year-to-date.

The ten year US bond yield finished the week at 2.66%, from 2.60% a week previously. The German equivalent was at 0.63%, moving higher from 0.57% a week ago.

The EUR/USD rate closed the period at 1.24, whilst EUR/GBP was at 0.88 having stabilised somewhat recently.

THE WEEK AHEAD

Wednesday 31 January

Eurozone inflation data goes to print where the consensus forecasts a figure of 1.3% (year-on-year) from 1.4%. Unemployment data for December is also released and is expected to be unchanged at 8.7%.

Wednesday 31 January

In what is Fed Chair Janet Yellen’s final Federal Open Market Committee (FOMC) meeting, no changes are expected to the US interest rates or the current outlook for 2018.

Friday 2 February

In the US unemployment report for January, the market expects 175,000 jobs to be created, with the unemployment rate remaining steady at 4.1%.

The team at Zurich Investments is a long-established and highly-experienced team of investment managers who manage approximately €22.4bn in investment of which pension assets amount to €10.1bn. To find out more about Zurich Life’s funds and investments, w: zurichlife.ie/funds t: @ZurichLife

l: linkedin.com/company/zurich-life-assurance-plc