Over 80 S&P 500 companies are due to report earnings this week, with highlights including Coca-Cola, Walt Disney and Rio Tinto, writes Ian Slattery.

Global equities finished in negative territory, despite shaving losses towards the end of the week on the back of well received US economic data. The January US jobs report stated that 227,000 jobs were created, well above the forecast 170,000. However, this was tempered somewhat by a slowing average earnings growth.

Ian Slattery

President Trump remained a key influence on markets as the fallout from his travel ban remained to the forefront of news reports during the week, weighing on both stocks and the US dollar. However, financial stocks were higher on the prospect of decreased regulation on Wall Street, whilst oil was higher as the US administration put Iran ‘on notice’ after it tested a ballistic missile.

In its first policy meeting of the year the Fed, as expected, left US interest rates unchanged. Lastly, earnings season continues to be positively received, with the majority of companies reporting last week beating expectations.

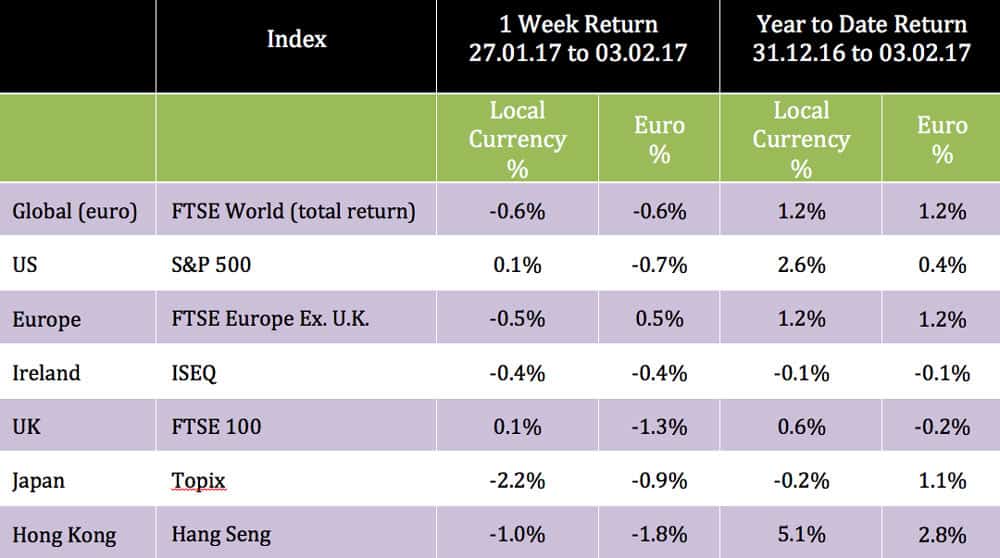

The global index trended downwards over the course of the week, finishing 0.6% lower in euro terms.

The global index trended downwards over the course of the week, finishing 0.6% lower in euro terms.

President Trump remained a key influence on markets as the fallout from his travel ban remained to the forefront of news reports

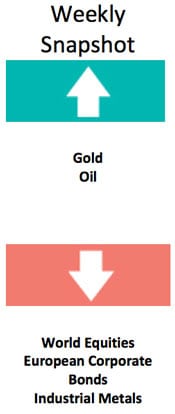

Copper paused for breath, following recent gains, returning -2.7% over the period.

Gold was positive 2.4% over the week, as investors displayed a more ‘risk off’ appetite.

Oil returned 1.4%, as supply concerns in the Middle East came to the fore.

The US 10-year bond was relatively flat during the week, moving from 2.48% to 2.46%. The yield on the equivalent German Bund closed at 0.41%.

Photo: jannoon028/Freepik

THE WEEK AHEAD

February 6th-10th

Over 80 S&P 500 companies are due to report earnings this week, with highlights including Coca-Cola and Walt Disney on Tuesday, and Rio Tinto on Wednesday.

Tuesday February 7th

US trade balance figures for December are released, where the deficit is expected to remain at just above $45bn. With the trade balance a key policy focus of President Trump, the political reaction will be closely watched.

Friday February 10th

The IEA oil market report goes to print were markets will be keen to see if OPEC is sticking to its production cut promises, and also if US production is increasing thanks to higher prices.

The team at Zurich Investments is a long established and highly experienced team of investment managers who manage approximately €20.8bn in investment of which pension assets amount to €9.9bn. To find out more about Zurich Life’s funds and investments, w: zurichlife.ie/funds, Twitter: @ZurichLife, LinkedIn: linkedin.com/company/zurich-life-assurance-plc