Confidence levels among Irish investors for both the global economy and Irish economy show a marked increase compared to this time last year, according to the latest RaboDirect Investor Barometer.

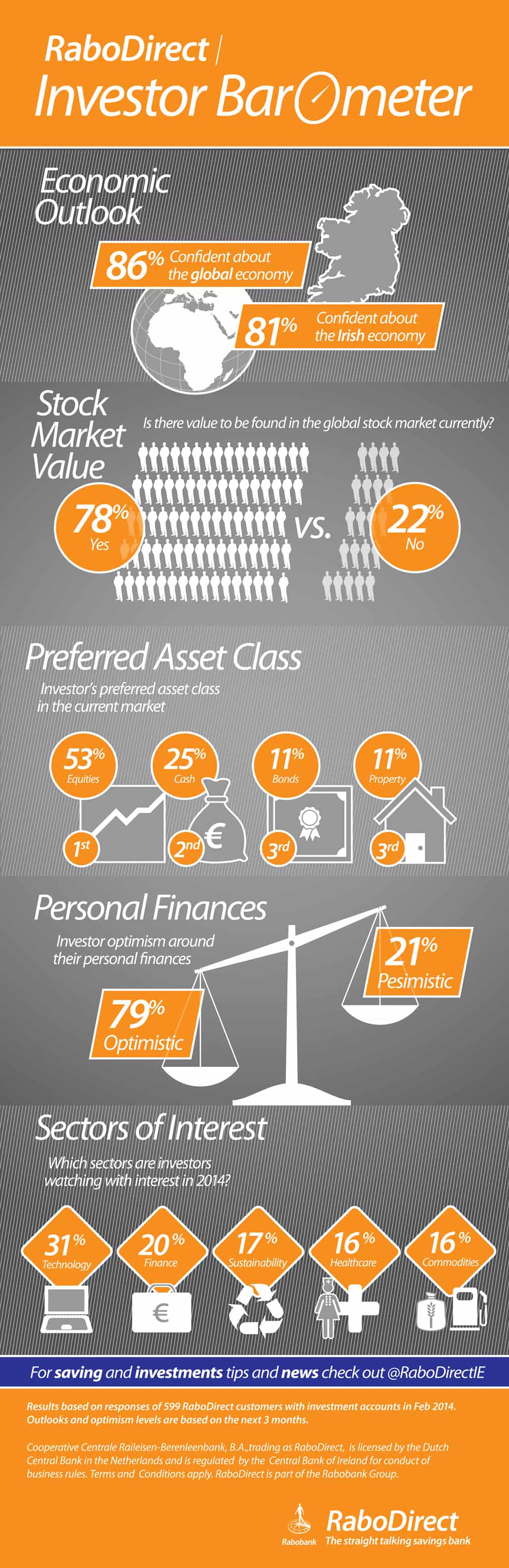

Some 86% of investors are now confident about the outlook for the global economy over the next three months, compared with 64% who were confident in Q1 2013. Results also show a sizeable increase on the domestic front, with 81% of respondents expressing confidence in the outlook for the Irish economy, compared with just 55% this time last year.

Optimism among investors about their personal financial situation over the coming three months remains strong at 79% and investors are favourably disposed to the global stock market with 78% saying they think there’s value to be found in stocks. This positive sentiment is reflected in investors’ preferred asset classes with a majority (53%) indicating a preference for equities, 25% preferring the safety of cash, 11% looking to bonds and 11% to property.

When asked which particular sectors investors would be watching out for over the remainder of 2014, 31% indicated the technology sector was of interest, 20% said the financial sector, followed by sustainability-related investments (17%), investments in healthcare (16%) and commodities (16%).

Year-on-year, results show that investor confidence in the Irish property market has increased too, with 62% saying they would be confident about investing in the Irish property market in the next three months, a significant jump from the 25% figure seen this time last year. Confidence around global property investment also increased from 33% in Q1 last year to 64% in the most recent survey (March 2014).

Killian Nolan, investment manager, RaboDirect says: “We’ve witnessed a significant pick up in Irish investor sentiment over the last year, aided by growth in the global economy and the more positive news streams on the domestic front around the country’s financial recovery and improved property prices, to name a few.

“In our opinion, this increased optimism is contributing to a slightly higher risk appetite when it comes to investors pursuing medium to long-term growth opportunities. The barometer shows the vast majority of investors questioned see value in global stocks and this is reflected in increased interest in Europe in particular.”