Pictured (L-R): Lawrence Vesey, Partner; Sia Partners, Eimear Cahalin, Chief Financial Officer & Co-Founder; Vivid Edge, David Cass, Partner; Sia Partners, Sarah Freeman, Managing Editor Business & Finance, part of Catalyst Media and Saragh Fitzpatrick, Chief Financial Officer; Houses of the Oireachtas

The Business & Finance CFO Index 2021, in association with Sia Partners, took place on Thursday 9th December, bringing together leading Chief Financial Officers from across Ireland and the UK.

Watch the CFO 100 Index Webinar on-demand video.

To download the full list, please click here.

To launch the Index, Business & Finance hosted a virtual thought leadership panel discussion on the key issues facing the CFO today. The event was opened by Business & Finance Managing Editor, Sarah Freeman. She was followed by David Cass of Sia Partners who delivered a keynote Partner Address.

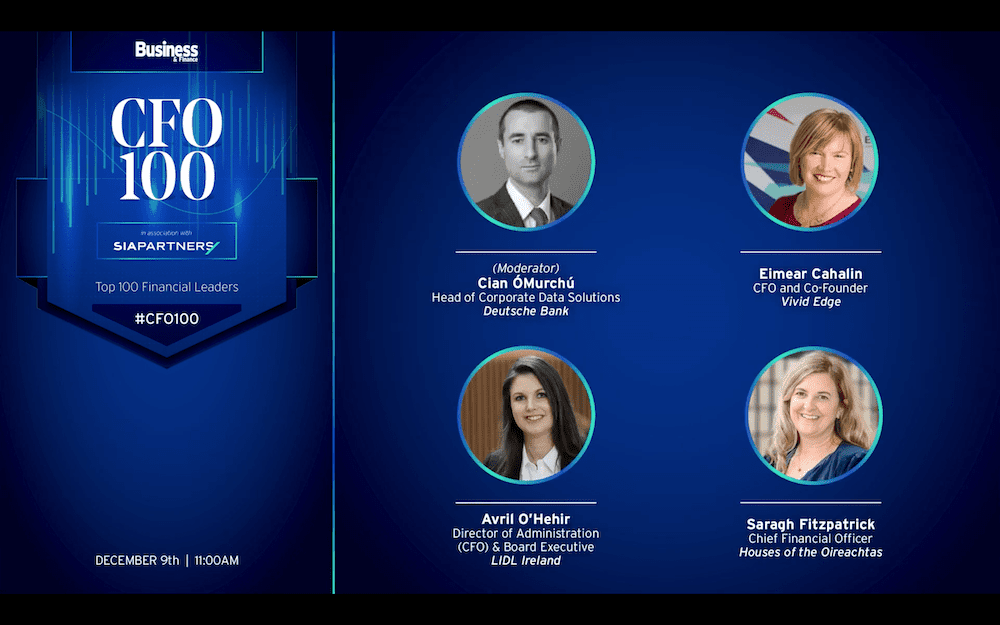

The virtual panel discussion followed and it was moderated by Cian ÓMurchú, Head of Data Control Solutions at Deutsche Bank. He was joined by three panelists: Saragh Fitzpatrick, CFO at the Houses of the Oireachtas; Eimear Cahalin, CFO and Co-Founder at Vivid Edge, and Avril O’Hehir, Director of Administration, CFO and Board Executive at Lidl Ireland.

The role of the Chief Financial Officer has evolved significantly since the onset of the Covid-19 pandemic with the global shift to remote working arrangements. Now, more than ever, the CFO must focus upon partnerships and analysis, as opposed to the strictly gatekeeping function that they maintained in the past. Our panellists delved into the constantly changing nature of their position during their virtual discussion. Here are some of the most notable takeaways from the event:

1. The Chief Financial Officer is no longer the same role that it was 10 years ago

David Cass: “The finance function has moved beyond the scorekeeper role of recording and reporting performance to becoming a true strategic partner, playing a key role in mitigating risk, driving strategy, and adding value. With this, the role of the CFO is becoming broader and ever more challenging, with a need to deliver consistent results in a fast-paced and uncertain global market.”

Eimear Cahalin: “10 years ago the role of the CFO was very much focused on financial reporting and controls whereas I think now it’s much broader, it’s into risk management, it’s into decision support, so it’s very much more a partnership role with the CFO role rather than a guardianship role. The analogy that I use is that in the past it was very much about looking backwards whereas now it’s about being in the driving seat of the car where the rear-view mirror is a much smaller piece of the picture than the windscreen through which you’re looking.”

2. Brexit and the Covid-19 pandemic have fundamentally changed the way in which the CFO operates

David Cass: “The ever-increasing turmoil in geopolitics as well as events such as the Financial Crisis, Brexit, and the pandemic have brought the CFO role and its challenges more to the fore.”

3. Staff retention is more important than ever

Saragh Fitzpatrick: “A huge part of the changes that we’ve made in the last two years during Covid were about staff change management … [Our staff] have effectively been in a period of change for the last two years. They’ve been adapting, delivering new solutions – there’s always a concern about the risk of burnout there, and it’s much more important now, I think, than ever, to try and prioritise some of the time and some of the energy that your staff spend.

4. CFOs offer valuable insights into all areas of the business due to their neutral perspective

Avril O’Hehir: “[The] CFO is in the middle, and they’re looking at finance, they’re looking at business models, and they’re able to have that neutral perspective to say, “okay, well, which is the correct strategy?” Because at the end of the day, you’re not as invested in regards to the decisions – of course invested in terms of the business results, absolutely, but whether it’s growing one area at the expense of the other, that’s something that the CFO should be able to balance and make sure that all areas are growing together to fulfil the business objectives, or the shareholders’ objectives.”

5. Rapid changes in technology have greatly affected the role of CFO

David Cass: “…The rapid development and adoption of new technologies [is] transforming not only how and where we work but also how our jobs and roles will evolve in the future. This landscape will be the new normal for finance operations for the foreseeable future.”