Parva Consulting is a niche management consultancy specialising in financial services. Since 2005, they have supported leading institutions in Asset & Wealth Management, Banking, Securities & Fund Services, and Insurance, helping them achieve lasting impact. With nearly 100 professionals across Milan, Dublin and Zurich, they combine deep expertise, firsthand experience and a pan-European perspective.

By Jack Daly

What if your five-year plan became irrelevant before Christmas? The volatility of the financial landscape means traditional planning often falls short. Many institutions see it as costly in both time and resources, without sufficient long-term value. Rigid annual cycles, outdated data, and a lack of integration create inefficiencies, leading to plans ill-equipped for surprises.

Where is scenario planning being used?

In financial services where risk is fundamental and capricious, scenario-based planning already operates at many levels. In banking, stress testing simulates adverse economic scenarios. For example, the European Banking Authority (EBA) conducts EU-wide stress tests to assess sector resilience to severe downturns, measuring GDP, capital ratios, income rates and other factors driven by geopolitical tensions, trade fragmentation and supply shocks. At the corporate level, ‘remember the future’ style workshops help analyse the impact of regulatory changes.

So what exactly is scenario-based planning, and how can it help?

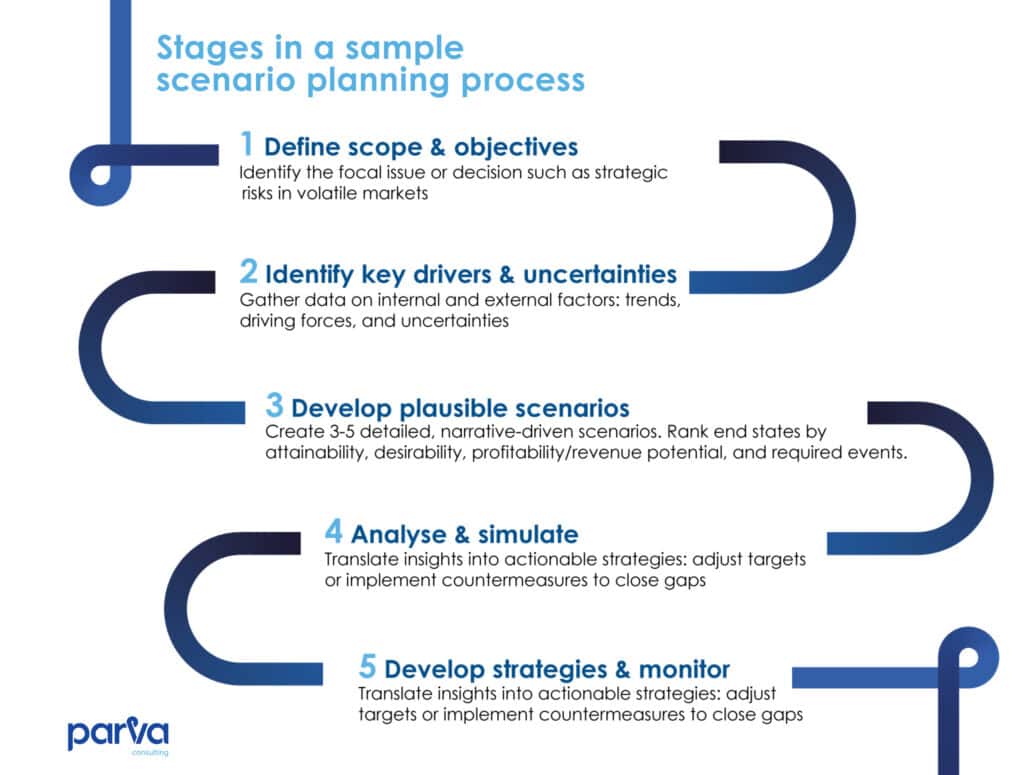

It grounds planning in real-world drivers, and rather than predicting a single outcome, organisations explore multiple plausible scenarios. It enables faster, better-informed decisions and offers tangible benefits from risk management to policy maintenance for regulated entities such as fund managers and banks.

How does it differ from other methods?

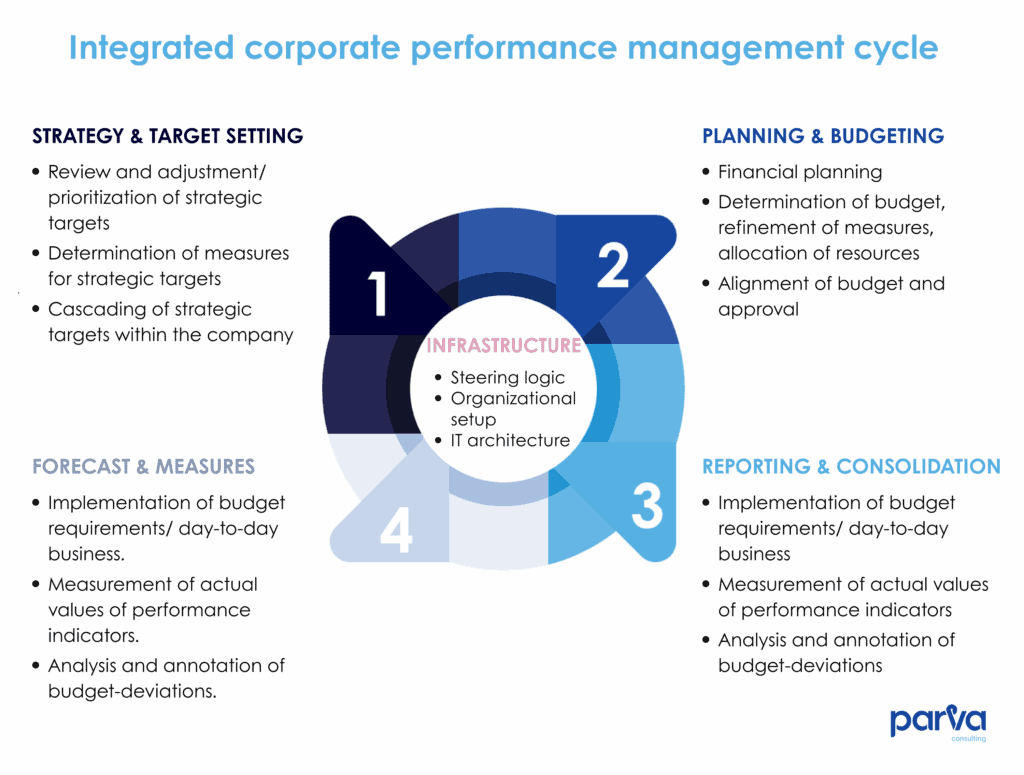

Scenario planning forces leadership teams to wrestle with different futures before they happen, and distinguishes itself in highly uncertain situations, aiming to understand a range of potential futures. Unlike traditional forecasting, which uses historical data for a single outcome, scenario-based planning is more qualitative, focusing on ‘what might happen’ in volatile, long-term environments. It shifts away from rigid annual budgeting to a dynamic, integrated approach using top-down processes with bottom-up inputs, incorporating scenario modelling, risk simulation, and rolling forecasts. What emerges are reduced inefficiencies and a logically integrated planning structure linking company strategy with modules, drivers and plans to ensure effective steering.

What are the benefits?

The advantages are substantial, particularly in enhancing resilience and decision-making. It improves risk management by identifying potential threats, encourages adaptability to change, and promotes innovation. In financial services, it ensures efficient steering by linking sub-plans, detecting deviations early and reducing inefficiencies. Combined with AI tools, this planning method provides a competitive edge, transforming planning from an obligation into a valuable instrument.

How to approach strategic scenario planning

Generally, the process starts with scope definition, moves to qualifying initiatives, employs models to evaluate likelihood and impact, and then uses forecasting to monitor and adjust. This top-down approach, with simulation toggling measures ‘on/off’, generates scenarios for discussion to arrive at details such as time horizon, key actors and actions, and resources needed to achieve a specific outcome.

Scenario-based planning stands as an important strategy for financial institutions navigating uncertainty. By moving beyond traditional methods to embrace flexible, driver-linked simulations, it delivers tangible benefits in risk mitigation, opportunity identification, efficiency, and resilience.

Learn more about scenario-based planning

The only certainty is uncertainty. Those who plan for multiple futures will always succeed over those who plan for just one. At Parva, we help financial institutions turn scenario planning into a strategic advantage, not just a compliance exercise. Discover more about scenario planning on Parva’s website.