Aidan Donnelly reflects on the repercussions of political moves on the world markets.

‘May you live in interesting times,’ is an English expression purported to be a translation of a traditional Chinese curse. Despite being so common in English as to be known as ‘the Chinese curse’, the saying is apocryphal, and yet no one has ever found an actual source for the curse – be it Chinese or otherwise. While its provenance may be questioned, its applicability as a description of investment markets over the last few months cannot.

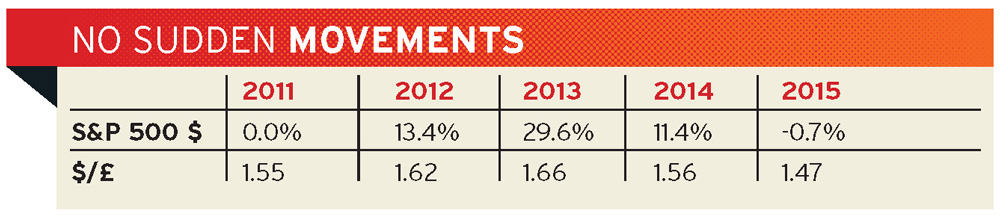

Once the initial Brexit result volatility abated, a certain air of tranquillity descended over stock markets as a strange mixture of the summer doldrums, a modicum of apathy, and a greater dose of ‘anyone know what happens next?’ converged to calm the seas. Perhaps the best display of this came in the US where the S&P500 index had a run of 44 trading days without a daily move greater than 1% (see chart overleaf). To the uninitiated this may not sound like a big deal, but such periods are rarer than you may think, particularly in the modern era.

And that’s not to say that we didn’t have events over the period that could have acted like a cardiac defibrillator, shocking life back into markets: strong economic data, weak economic data, two month end rebalances, company results and volatile commodity markets, to mention just a few.

YELLEN FROM THE ROOF TOPS!

Above all else, markets had to contend with the seemingly constant stream of speeches and insights from a plethora of central bank officials. And why you might ask was this important? The answer was that all eyes were focused on the US Federal Reserve (FED) chairperson, Janet Yellen, to see the next move for interest rates, firstly at the September meeting and now at the December one.

While Yellen will concede that the rate hike case has strengthened in recent months, given the continued solid performance of the labour market and the Fed’s own outlook for economic activity and inflation, actions speak louder than words. And so far we remain on hold.

GAME OF TRUMPS

Of course the other US phenomenon that has been playing on investors’ minds is the likely outcome of the presidential race. While it might seem that some of the debate has the intellectual content of an episode of Keeping up with the Kardashians, the bigger long term issue may come, not from who eventually wins the election, but from the fact that either way the next US president will have the lowest voter approval rating of any incoming president in history.

… all eyes were focused on the US Federal Reserve chairperson Janet Yellen

The divisive nature of the campaign will mean there will be large segments of society unhappy with the outcome no matter what. And this, coupled with the internal political party fallout, could see the next four years playing out like a ‘lame duck’ presidential session, with little in the way of policy decisions just at the point when the country and potentially the globe, needs clear and definitive action.

MAY BE, MAY BE NOT!

As the final quarter of the year kicked off there were certainly a few fireworks to announce its arrival. It might have been a month early for Guy Fawkes, but that didn’t stop a modern day figure from lighting a fuse as UK Prime Minister Theresa May spoke at her party conference and suggested that Article 50 will be triggered before the end of March next year – this starts to give the Brexit process some shape and we now know that UK membership of the European Union will likely cease in Q1 2019.

The rhetoric from the Conservative Party conference should dispel any thoughts in the market that Brexit might be watered down, with the government pretty clear that it thinks the vote means that migration needs to be controlled and it will try to negotiate the best trade deal possible with that constraint. While the political ramifications of this will take some time to appear, there was no denying the market and economic impact of what this process means.

A NOT SO STERLING PERFORMANCE

The one asset that is clearly in the firing line when it comes to Brexit is the currency. In the wake of Theresa May’s speech the weakness in sterling gained traction, culminating in a particularly volatile two days on October 6th and 7th. The majority of action has been focused in the ‘cable’ market – the £/US$ exchange rate – and Thursday October 6th saw sterling down sharply, in the process making a fresh 31-year low at $1.262.

But that wasn’t the end of it – in the early hours of Friday, the freefall continued and at one stage the pound collapsed over 6% to an intra-day low of $1.1841 in just two minutes. That marks the biggest intra-day drop since the Brexit fallout on June 24th and the lowest level since May 1985.

Although it did rally back as much of the blame was being laid on computer-driven orders at a time of day when liquidity is at its thinnest, the move unsettled many nerves and left many international investors nursing negative returns.

PROPHETS OF PROFITS

Aidan Donnelly, Davy

So if equity market investors had gorged on a diet of politics – be it in the form of debate (Brexit) or intrigue (US presidential election) or monetary policy (when will the US Federal Reserve increase rates) up to the middle of October, the menu then changed with the ‘seasonal’ introduction of corporate profits as US companies begin reporting their Q3 financial results.

The final hope to cling to comes from the usual earnings season game

While it might seem obvious that an analysis of the financial ‘wellbeing’ of companies is a key element of the investment decision, it had been put on the back burner as more macro issues come to the fore.

When companies began to release their numbers, analysts had expected the aggregate profit from companies in the S&P500 to decline by 2.1% year-on-year. While we still have more companies to come, should the eventual outcome be a decrease in profits for the quarter, it will mark the first time we have seen six consecutive quarters of year-on-year declines in profits since early 2009 – and only the fourth time in 30 years.

What is potentially more interesting is that it will be the first time that it has occurred while the economy was not in recession.

ALL BAD NEWS?

For the optimists among you, there are some straws of hope at which to clutch. During Q3 we saw analysts make smaller-than-average cuts to their forecasts than would be normal by historical standards. In addition, a smaller percentage of company managements lowered the bar, with just 80 of the 114 companies that changed expectations reducing profit targets.

The final hope to cling to comes from the usual earnings season game – this sees analysts reduce expectations to allow companies to ‘surprise’ the market with better-than-expected results.

If this quarter follows the historical trend and the degree of improvement in growth rates is similar, it is possible that the eventual outcome will not be a decline in profits for the third quarter. Whether that makes a difference and drowns out the other macro headlines, only time will tell.

About the author: Aidan Donnelly is head of Equities at Davy Private Clients. Views expressed in this article reflect the personal views of the author and not necessarily those of Davy. Follow him on Twitter @aidandonnelly1. J&E Davy, trading as Davy, is regulated by the Central Bank of Ireland.