Fintech start-up Stripe has reached a $20.25 billion valuation following the closing of a $245 million funding round.

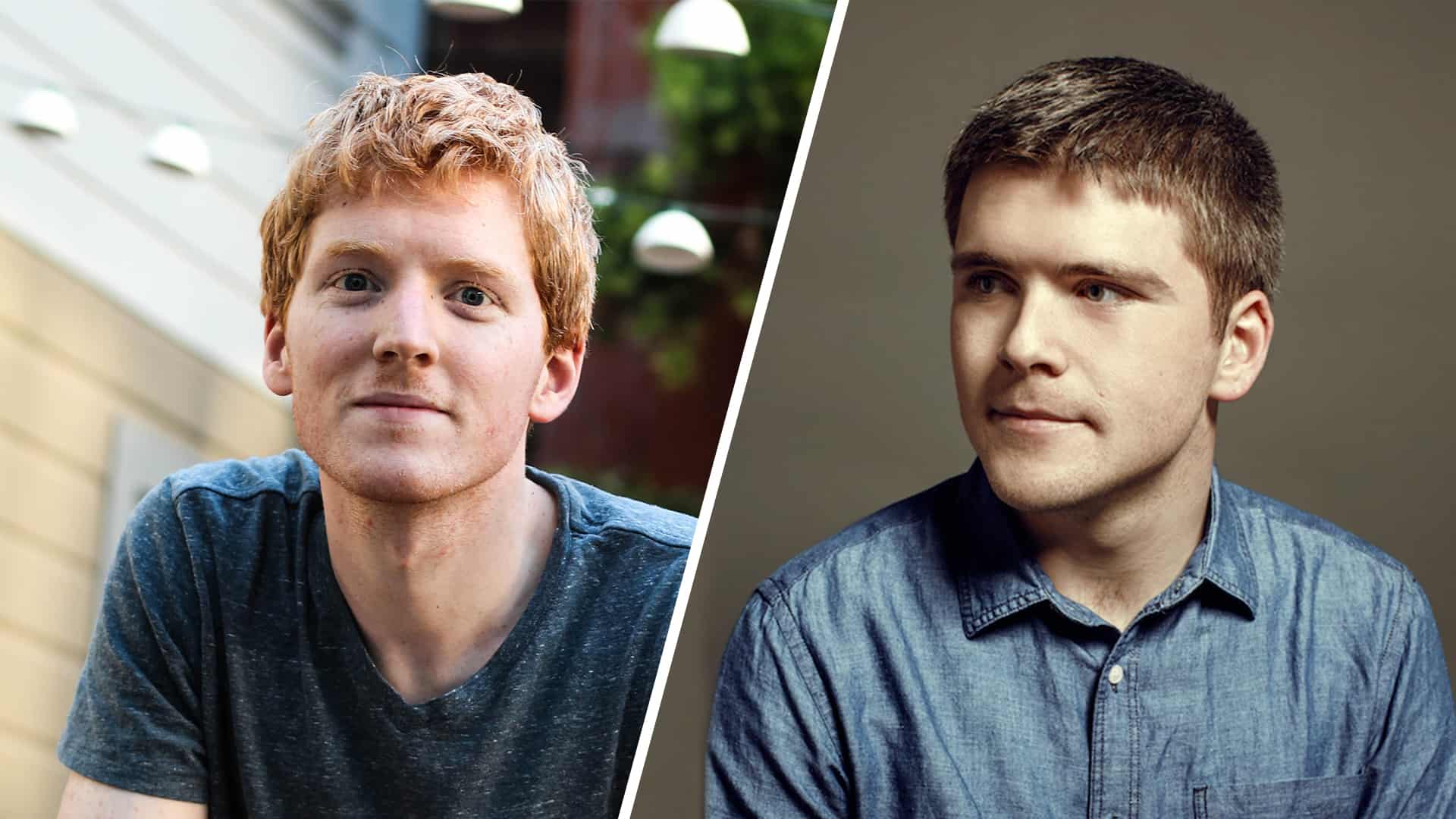

As a result of that latest round, led by billionaire investor Chase Coleman’s hedge fund Tiger Global Management, along with DST Global and Sequoia, the online payment processing firm co-founded by the Limerick-born Collison brothers saw a dramatic surge from its most recent $9.2 billion valuation in 2016.

San Francisco-based Stripe will use the funds to fuel growth in key overseas markets such as Southeast Asia and India, where it plans to tap into the growth of the ecommerce industry to expand its payments products.

New Clients and Future Expansion Plans

More than 500 million people in Southeast Asia and India are expected to become online customers in the next three years, the company said.

In July, the startup partnered with digital payment providers Alipay and WeChat Pay to enable merchants using its platform globally to accept payments from hundreds of millions of Chinese consumers.

After launching in 2010, Stripe quickly became the payments service of choice for other Silicon Valley startups and on Wednesday the company announced additions to that blue chip client base.

Alphabet Inc’s Google, ride-hailing services Didi and Uber Technologies Inc and music streaming service Spotify Technology SA were added to the company’s portfolio of customers.

Stripe increasing European workforce in Dublin

Stripe also said it will open a new engineering hub in Singapore while the company announced plans earlier this year to increase its engineering workforce at its European HQ at Silicon Dock in Dublin.

The company’s model is that, with a few lines of code, it replaces the more time consuming, and often more expensive route, of working with banks and other payment providers in a complicated chain of players and makes it straightforward for businesses.

Stripe allows businesses access to their platform in exchange for a small fee on transactions. Its products have expanded to include credit cards, subscription-based billing and debit cards.

“We think this investment will be helpful as we continue to march upmarket and serve these larger companies,” said John Collison, who co-founded the company with his brother, Patrick.