Pictured: Paula Byrne, Advanced Tax Lecturer, Griffith College

Paula Byrne lectures Advanced Tax on the MSc in Accounting & Finance at Griffith College. Here, she explores the tax implications on pensions.

Job wise, I used to be a very important person. In fact, I was a legend in my own lunch time. Babies arrived and I suddenly found myself to be considered far less important. It was the late 90s after all. I pivoted my career in a totally different direction and moved on to better things, which is the beauty of a professional accountancy qualification. Fast forward a number of years and at 49, a letter landed on my doormat. The employers from my time in the aforementioned very-important-person-job, were transferring my occupational pension to another fund manager.

Honestly, I wasn’t overly interested. The husband, however, was extremely excited. He enjoys reading the small print and noted quickly that the early retirement age on this new occupational pension was age 50. What did this mean? It meant that in a year’s time I could access a tax-free lump sum from said pension.

And that is exactly what we did. With my tax-free lump sum, my husband got himself a lovely boat for cruising down on the Shannon. He says it’s our boat but I’m under no illusion. It‘s definitely his boat.

So how did all this come to fruition? Well let’s start at the basics. There are 3 types of pension: state pension; personal pension and occupational pension.

Type One – State Pension:

State Pension (Contributory) which is payable at age 66 to people who have satisfied certain PRSI conditions, and

State Pension (Non-Contributory). This is a means tested pension for people aged 66 or over and who do not qualify for the Retirement Pension or Old Age (Contributory) Pension.

Whilst both of these are fairly generous by an EU standard, they might not get you your boat on the Shannon.

Type Two – Personal Pension

This is the type of pension contributed to by sole traders or employees who don’t have access to an occupational pension scheme.

Type Three – Occupational Pension

This is company pension scheme set up by your employer. Both the employer and employee can contribute towards this pension.

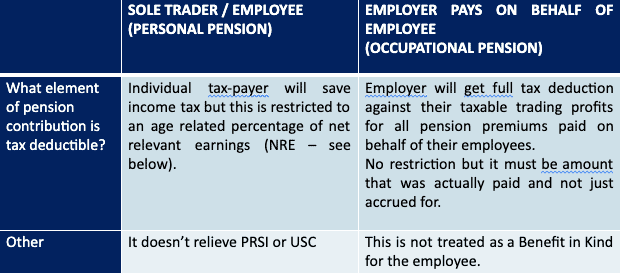

Your Pension Contributions and Tax

No doubt you will have heard that making a pension contribution is very tax efficient. That is true. However, the degree of tax efficiency depends on the type of pension.

Below is a summary of the rules surrounding the different tax treatments:

Firstly, let’s define net relevant earnings (NRE). Broadly, it’s earnings from a self-employed trade or profession. In addition, it can also be income from a non-pensionable employment, i.e. earnings from a job that are not being pensioned in a company pension plan. (If you are included in a company pension plan only for a lump sum death-in-service benefit you are deemed to be in non-pensionable employment and to have relevant earnings for the purposes of this type of pension).

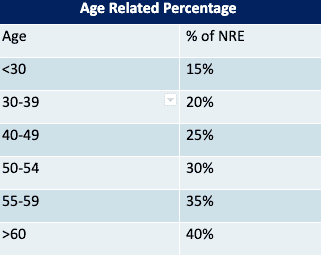

It’s worth knowing that dividend or rental income is not considered to be NRE, and therefore any pension contribution with this type of “passive” income will not qualify for a pension tax break. It’s also worth knowing that the age-related percentage means that the older you are, the more of a tax break you will get in relation to a pension contribution as follows:

You should note that NRE is capped at €115,000 and also the pension contribution won’t relieve USC or PRSI. Let’s take a look at a few examples.

Personal Pension

Example 1

My self-employed income is €55,000 and I’m 40 years old. I invest €15,000 into personal pension. How much is tax deductible?

€55,000 x 25% = €13,750.

But you have to remember that this relieves income tax only. So the saving to me is only €13,750 @ 40% = €5,500.

But I want to invest €15,000, so what happens to the excess that is contributed above my limit of €13,750 i.e. the €1,250? This has to be carried forward and tax break would apply the following year, provided I still qualify under the age related percentage rules the following year.

Example 2

My self-employed income is €160,000 (remember the NRE limit is capped at €115,000). I am 50 years old and I invest €48,000 into personal pension. How much is tax deductible?

€115,000 (remember it’s capped) x 30% = €34,500

This relieves income tax only, so the saving to me is only €34,500 @ 40% = €13,800.

What happens to the unrelieved element of the pension contribution €13,500? (difference between €48,000 and €34,500). Again, this is carried forward and tax break would apply the following year, as long as I qualify under the age related percentage rules.

The moral of the story here is that if I’m fortunate enough to be able to afford to contribute a sizeable amount into my personal pension, not all of this sizeable contribution would attract a tax break. This is quite restrictive because it only relieves income tax, there’s a cap on the NRE and there’s an age related percentage restriction.

Now onto the exciting bit.

The Occupational Pension:

When an employer contributes to a pension on your behalf, the business gets a full tax deduction. There is no age related percentage shenanigans, nor is there a NRE cap on their contribution. Similarly, the employee is NOT treated as receiving a benefit in kind, so no taxation for them. Fabulous. (Note however, that any employee contributions are treated with the same restricted shannigans as if the employee was contributing to a personal pension as above).

That’s the contributions dealt with. What happens when you get to retirement age?

The Drawdown on Retirement age

For the personal pension, at retirement a lump sum can be accessed but this is restricted to 25% of the value of the fund. The remainder 75% can be invested into an ARF/AMRF or an annuity.

However, for the occupational pension scheme, there are 2 options: Up to 1.5 times your final salary can be accessed as a lump sum. The remainder is then invested in an annuity. There is also the also the option of a 25% lump sum with the remainder invested into an ARF/AMRF or an annuity. In all options the tax-free element of the lump sum is restricted to €200,000. The second €300,000 is taxed at 20% and the remainder at 40%.

Example

My final salary is €120,000, and I have 20 years’ service. The pension provider informs me that my pension fund is worth €180,000 at time of my retirement.

Option 1: Lump sum 1.5 times salary plus annuity

The 1.5 times final salary option is only available within an occupational pension scheme. The lump sum available is 1.5 times €120,000 (final salary) = €180,000. Therefore, there is no need to purchase an annuity. THE ENTIRE DRAWDOWN IS TAX FREE as it’s under the €200,000 limit.

Option 2: 25% route plus an ARF/AMRF

This is the only option available for a personal pension and is an option for an occupational pension. I would be entitled to lump sum 25% x 180,000 (pension value at date of retirement) = €45,000 plus ARF/AMRF fund of €135,000 with the difference (180k – 45k). With this option, I would have access to a significantly smaller tax-free lump sum.

The Jargon

You may be wondering what the difference is between annuity, an ARF and a ARMF is. An annuity is the opposite of a life insurance policy. You invest a lump sum and it pays out a fixed regular income for rest of your life. Generally, it dies with you (or your Spouse). If interest rates are low, as they are now, the resultant pension will be low. This makes this an unpopular product at present.

An ARF has potential to grow/decrease in value. An ARF gives you control over types of fund to invest in. Instead of automatic income, you withdraw when you need it.

Income from both an annuity and an ARF are taxed under PAYE when you withdraw, (there is a deemed withdrawal of 4% per annum on ARF after aged 60).

An AMRF is more restrictive than ARFs as you can only withdraw a maximum of 4% each year until you reach age 75. At age 75, or earlier if you meet the below criteria, you can convert your AMRF to an ARF.

Revenue rules require you to set up an AMRF unless one of the following statements applies to you:

- You have a guaranteed income payable for life (for example, State Pension or other annuity income) of more than €12,700 per year

- You already have an AMRF with an investment amount of at least €63,500

- You are older than 75

Hopefully you can that the golden child between the annuity, ARF and AMRF is the ARF!

To summarise, an occupational pension scheme gives access to a potentially higher tax free-lump sum as well as being potentially more tax efficient when the initial contributions are being made. However, you may be forced to invest in an annuity rather than an ARF.

My advice to you is to convince your employer to set up an occupational pension scheme and contribute to it as well as your employer.

Happy boating!

For a more in-depth review of all things tax, join Paula in either Griffith College’s ACCA/CPA Professional Accountancy School or in the Graduate Business School with Griffith College where Paula lectures Advanced Tax on the MSc in Accounting & Finance.

Griffith College have also recently announced a new specialised pension module within the Graduate Business School along with two exciting new courses taught in conjunction with the IIPM (Irish Institute of Pensions Management), the Higher Diploma in Pensions Management and the Certificate in Pensions, Insurance and Investment.

Note from author: Always seek independent financial advice.