Numerous absorbing and dynamic interviews and features have graced the pages of Business & Finance during its history. Through the Decades looks back at a selection of these articles.

Steve Forbes, 2007

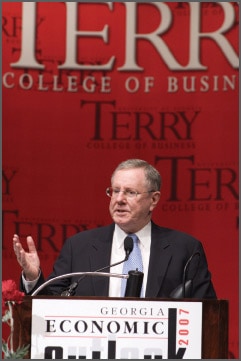

Steve Forbes, president and chief executive of privately held media company Forbes and editor-in-chief of Forbes magazine, speaks to Constantin Gurdgiev and Peter Nolan about many of the key issues that face commerce globally.

With a circulation in the US of some 900,000, Forbes magazine is the leading business magazine there. It’s known for its strong defence of free enterprise and celebration of business success, including its annual ‘Forbes 400’ ranking of the richest Americans. It also has some five million readers among its worldwide editions published in Chinese, Korean, Japanese, Russian, Arabic, Hebrew, Polish and Turkish.

Steve Forbes writes his Fact and Comment editorial column in each issue. A widely regarded economic commentator, he is the only writer to have won the prestigious Crystal Owl Award four times − awarded to the financial journalist whose economic forecasts for the coming year have proved the most accurate. Forbes also comments on current affairs regularly on Fox News and other broadcasters.

In both 1996 and 2000, Steve Forbes campaigned for the Republican nomination for the presidency. His signature campaign issue has been flat tax − a radical simplification of the tax system where a single rate applies to all income, with the elimination of all tax breaks and credits with the exception of a generous starting allowance. He advocates a flat tax of 17% on all personal and corporate-earned income, with a $13,000 tax-free allowance for each adult and a further $5,000 for each dependent.

Now 59, he has spent his career at Forbes, the media company founded by his grandfather and then run by his uncle and father before he took over in 1990.

UNCERTAIN PHASE

UNCERTAIN PHASE

The year 2007 is shaping up to be a period of uncertainty for the US and the world economy in general. US housing markets, for long a source of major concern, are sending mixed signals. Inflation is behaving in a highly unpredictable way, while prospects for economic growth are softening. Many analysts believe that the possibility of an economic slowdown will dominate the news in 2007.

According to Forbes, main expected shocks on the policy side for 2007 include the US congressional Democrats attempting to raise taxes on capital gains and dividends. Higher taxes on what is commonly perceived to be “excessive” executive pay are in the works. The Democrats are also likely to hold punitive hearings against pharmaceutical and energy companies, with an aim to putting price controls on prescriptions and slapping more taxes on the villainous oil industry.

One event still below the radar will be a serious Washington push to bail out General Motors, Ford and Chrysler, with the federal government absorbing a big portion of those beleaguered companies’ healthcare and pension costs. After all, Forbes thinks advocates will argue Washington has done similar favours in the past for the railroad and coal mining industries, not to mention loan guarantees given to Chrysler in 1980.

And look at the goodies Uncle Sam routinely showers upon agriculture. Legacy airlines will follow suit by claiming they too should be part of the package – as could the steel industry if profits plummet because of a weak economy or if the Fed finally pops the commodities bubble. Would George Bush sign such a bailout? Forbes thinks so.

On the other hand, there are reasons for optimism. The US economy’s strengths are real, even if commonly unreported by the media. “Consumer balance sheets are in excellent shape, as are their corporate counterparts. Services continue to expand, especially in high-tech sectors; semiconductor demand will be strong for both 2007 and 2008. These strengths will overcome the housing slowdown and weaknesses in manufacturing, including autos,” says Forbes.

He considers commodities to be the best leading indicators of economic activity, and disagrees with former Fed chief Alan Greenspan and his replacement, Ben Bernanke, by taking the commodities market, and gold in particular, as a key indicator of monetary trends. “The Federal Reserve will go on mucking up monetary policy, so expect higher interest rates, and bipartisan attempts to ‘solve’ social security’s actuarial black hole by raising payroll taxes.”

Why would stocks go up in this environment, one may ask? Forbes has his own view on this trillion-dollar question. “Equity prices already reflect much of this negativity around the fundamentals. During bull markets, the operative investment phrase is ‘climbing walls of worry’. A notable absence of irrational exuberance in investors’ attitudes is common for much of a rising market. In the retrospectively giddy 1990s, for example, it wasn’t until 1999 that everyone threw caution to the wind.”

Since the beginning of 2007, the dollar has been slowly weakening against other currencies. “The culprit is not the trade deficit − the greenback showed strength against the euro in 2005 and much of this year, even though our trade account is allegedly drowning in red ink,” says Forbes. “The culprit is the Federal Reserve, which has been printing money at an inflationary pace and at a faster clip than the Bank of England, the Bank of Japan or the European Central Bank.

“The best gauge of monetary disturbance is gold. It’s no surprise the dollar price of the yellow metal has shot up in recent weeks. Unfortunately, most central bankers still try to steer monetary policy by guessing the appropriate level of short-term interest rates.”

Is Forbes worried about the US twin deficits? In recent weeks, the US trade deficit has risen to over 6% of GDP. Although there has been some moderation in fiscal deficits, many economists are concerned that these gains will be erased by the long-term crisis in social security, Medicare and Medicaid programmes. “A trade surplus,” claims Forbes, “is equated to a country turning a profit and a deficit to a nation’s running at a loss.

But nations don’t trade with each other − individuals and entities do. Forbes has had a deficit with its paper supplier for more than 89 years. Yet this ‘imbalance’ persists because each side thinks the transaction is beneficial: the paper company makes money-selling paper, and we make money printing editorial content and advertisements on it. In other words, trade numbers are simply one number among many. In and of themselves they tell you nothing about an economy’s health.”

Last year, the US tax holiday for repatriation of corporate profits from the US multinationals contributed significantly to the decline in net investment inflows into Ireland. As US companies transfer profits earned through their Irish operations back into the US, there is a growing fear that further extensions of the holiday period will result in a weaker foreign direct investment position in the Republic.

According to Forbes, tax holidays must be extended further. This “makes excellent economic sense”, he says, although “this policy would be unlikely under the Democrats’ controlled Congress”.

FLAT TAX REVOLUTION

Tax holidays bring us to Forbes’s lasting passion for advocating a flat tax revolution in the way the governments around the world raise their revenue.

John Marshall, first chief justice of the US, wrote, “The power to tax is the power to destroy.” Prof. Gary S Becker, a Nobel Prize winner in economics, adheres to the view that taxation, like theft, is an example of involuntary transactions that are fundamentally inconsistent with moral principles of individual freedom and self-determination.

In recent years, in response to both the economic necessity to alleviate the negative effects of selective taxation policies and the democratic imperative to make fiscal policies more transparent and egalitarian, several countries around the world moved to adopt flat rate taxation. Under a flat tax system, all income earned by individuals and companies, other than a tax-free personal allowance, is taxed at a single, low rate.

There are no complicated exemptions or exceptions. Forbes is one of the best-known advocates of the flat tax, having made his flat tax proposals for the US federal government a main prong of his 2000 presidential campaign.

Environmental extremists are not using the green movement to give us cleaner air and a higher standard of living as we grow and expand economically, but to halt economic progress altogether

One of its modern proponents was late Nobel laureate in economics Milton Friedman, who sketched out such a system in his bestselling book Capitalism and Freedom. Hong Kong has had a version of a flat tax system since 1947. Among the economies of central and Eastern Europe, Estonia, Lithuania, Latvia, Russia, Serbia, Ukraine, Slovakia, Georgia, Romania and Macedonia have enacted the flat tax. Greece and Croatia are now planning to do so.

Forbes sees the flat tax as a major opportunity to improve the functioning of the US’s fiscal system. “Under the plan I proposed for the US, for instance, a family of four would pay no federal income tax on their first $46,000 of income and would pay only 17% on any income above that $46,000. For a family of six, the exemption would amount to more than $65,000.

There would be no tax on savings – no levies on dividends, interest and capital gains. For businesses, profits tax would be cut from the present rate of 35% to 17%.”

There is sound economic evidence behind these proposals, claims Forbes. Economic boom and a rise in tax receipts followed the 23% reduction in income tax rates across the board enacted by John F. Kennedy. After the Reagan tax cuts, even though the top rates of tax fell from some 70% to 28%, income tax receipts almost doubled. Russia enacted a flat tax at 13% in 2001.

Equally important to Forbes is the fact that, as rates of taxation in the US became more compressed, the taxation burden shifted more on to the wealthy, reducing the relative penalty on the poor and the middle classes. Flat tax “is not a left-wing or right-wing idea”, says Forbes. It’s a meritocratic and a more egalitarian system than the current progressive taxation with a multitude of deductions and exemptions.

IRELAND AS TAX EXEMPLAR

According to Forbes: “Ireland is a model for what happens when taxes are brought down to a reasonable level and the number of tax bands is reduced”. This makes our tax system more comparable with the flat tax system. But Ireland is an unlikely candidate to adopt flat tax, as the country’s appetite for reforms has diminished over recent years. Instead, Forbes thinks the first EU15 country to adopt flat tax “might even be France under Sarkozy, or Italy under Prodi.

Even the Spanish socialists might be interested. Or [Germany’s chancellor] Merkel, if she can govern with just the Free Democrats and not have to accommodate the Social Democrats. One of the big continental economies, Germany, France or Italy will lead the continent in reform”.

Germany appears a good candidate to lead these reforms. “During national elections last year, [Merkel] hinted she was in favour of junking Germany’s tax code and replacing it with a simple flat tax.

But she was unwilling to defend the idea, slinking away when the inevitable attacks came. It was one of the critical factors that turned what should have been an electoral landslide for her into a near-defeat, forcing her to cut a deal for a coalition with the major opposition party, thereby leaving little room for manoeuvring.”

Why should a big EU country lead the charge? According to Forbes, large EU economies are in a state of persistent crisis. “Look, a 2% growth is a boom in Germany, but it is a growth recession in the US.” On the other hand, US experience with tax cuts should sooner or later get the message to the Europeans.

“The [US] tax cuts of 2003 were immensely successful. We had several years of growth above 4%, and created more jobs than Europe and Japan combined.” This growth alone has added to the US economy the equivalent of what China is worth in its totality. Yet, one long-term drag in policy remains unaddressed by the US. In Forbes’s words: “On the spending side, it’s been a disaster with both parties.”

OIL, GLORIOUS OIL

High-energy prices are currently at the top of the agenda for European and American policymakers. On the other hand, as the latest UN environmental debates indicate, the US is going to experience increased pressure to draw down harmful emissions. The environment and high oil and gas prices are the favourite policy agendas of today’s left.

Yet, many policymakers are missing the boat. Real problems with energy supply are not caused by the shortage of oil, but by the internal policies of wealthy states.

Yet, many policymakers are missing the boat. Real problems with energy supply are not caused by the shortage of oil, but by the internal policies of wealthy states.

Socialism and communism are dead, discredited by the ghastly experiences of the 20th century

For example, Forbes claims, “worries about oil spills is what fuels opposition to open up the bulk of the US outer continental shelf. Environmentalists are mute about the fact that last summer’s devastating hurricanes did not lead to oil spills like that of the Exxon Valdez. Similarly ill-informed emotionalism has severely retarded the development of nuclear power in the US”.

The environmental agenda based on these rather extremist premises is bound to misfire. “Environmental extremists are not using the green movement to give us cleaner air and a higher standard of living as we grow and expand economically, but to halt economic progress altogether. Socialism and communism are dead, discredited by the ghastly experiences of the 20th century. But the socialist agenda lives on in this perversion of environmentalism.”

Sadly, many policymakers are starting to gravitate toward the position of supporting less-than-sound policies to make sure that US and European companies have incentives to conduct research into and development of alternative fuel sources and cleaner technologies.

What is needed are sound economic and monetary policies, not a knee-jerk reaction. When inflation was brought under control in the 1980s, the cost of oil plummeted, reaching a low in 1986 of $10 a barrel. As credit creation expanded, the price of oil rose again. Then, in the late-1990s, the Federal Reserve inadvertently tightened money supply, sending the price of oil crashing. The cycle repeated in the late-1990s: exploration was sharply reduced, and the price of oil started moving up again.

“We are not running out of oil. The recent major discovery in the Gulf of Mexico is the latest verification of this. A lot of money is being invested in alternative energy sources, and many of these endeavours will come a cropper if the assumption of ever-higher oil prices proves false. Then there will be ever-louder cries for expensive government subsidies to help out.”

SETTING THE SCENE – 2007

Republicans George W Bush and Dick Cheney were ruling with their particularly credulous brand of politics in 2007 in the US.

Steve Forbes joined Rudy Giuliani’s campaign for the 2008 presidential election in March 2007, serving as a national co-chair and senior policy advisor – later, in the 2008 presidential campaign, Forbes was to serve as John McCain’s economic adviser on taxes, energy and the budget during McCain’s bid for the 2008 presidential election.

Some noteworthy events to take place in the US throughout 2007 included the announcement of the release of the first iPhone; Microsoft’s release of Windows Vista and Office; and senator Barack Obama of Illinois declaring his candidacy for presidency.

Some noteworthy events to take place in the US throughout 2007 included the announcement of the release of the first iPhone; Microsoft’s release of Windows Vista and Office; and senator Barack Obama of Illinois declaring his candidacy for presidency.

The US House of Representatives passed the Matthew Shepard Act – the first time that the House had brought a gay rights bill to a vote, while wildfires in southern California caused havoc.