Marc Coleman, founder of Octavian Public Affairs, discusses Ireland’s Green Brand and how our resilient food industry can lead the recovery and symbolise it.

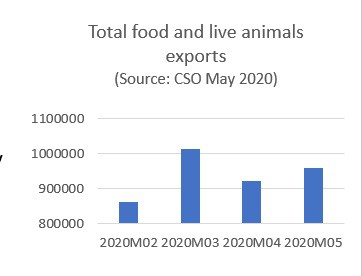

So, let’s start with some good news. After falling significantly in April, food exports have risen in May, back above levels recorded in February (but not yet March levels). The March peak most likely reflects demand created by emergency stockpiling in the early days of lockdown. So, in all likelihood, March’s benchmark is abnormally high.

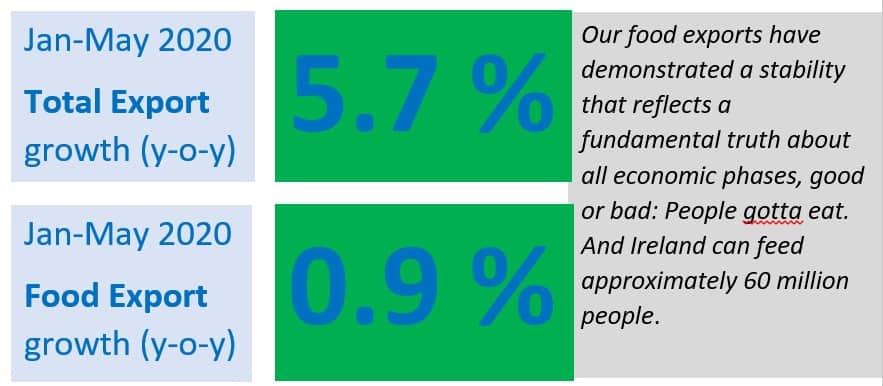

Compared to last year, food exports in the period of January to May combined were down slightly, by 0.9 per cent. While this seems low compared to overall export growth of 5.7 per cent, the latter figure is distorted by particularly strong increases in chemical and pharmaceutical exports to the US.

When that factor is accounted for, our food exports have demonstrated a stability that reflects a fundamental truth about all economic phases, good or bad: People gotta eat. And Ireland can feed approximately 60 million people.

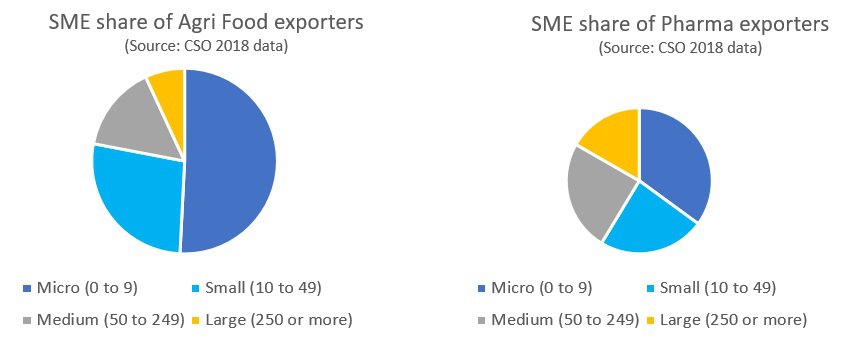

Indeed, the contrast between Ireland’s food and pharmaceutical industry points to a second reason why the food industry – besides its economic resilience – is so important.

Source: Central Statistics Office (CSO) Trade data, May 2020

As elaborated in An Economic Response to Covid-19 last April policy supports need to be sectorally focused and focused also on the most vulnerable small business sector.

As the charts comparing the relative sizes of enterprises in the Food and Pharmaceutical sectors demonstrate, the Food sector is relatively more oriented towards micro (0 to 9 staff) and small (10 to 50) sized enterprises, with over three quarters of enterprises falling into these two categories where funding resources, export reach and ability to absorb Covid related restrictions are most challenged.

The food sector is also more labour intensive and accounts for a higher share of rural and regional employment than most other sectors. For those reasons – and others – specific State Agencies (Bord Bia and Bord Iascaigh Mhara) are dedicated to their promotion.

But large Irish food companies are crucially important: Ireland’s success in the Chinese baby milk powder market and, until recently, the beef market demonstrates what a good brand can do. Recently affected by factors arguably outside Ireland’s control, and by a heightened anxiety on the part of Chinese food authorities, Ireland’s stunning export success in China has taken a breather recently.

Overall, however, and in the long term – provided Ireland’s Origin Green brand is protected and promoted – our food sector can continue to grow. The most immediate challenge to that growth is, of course, Brexit. As well as slowing demand in Britain (the UK economy declined by 20 per cent in the first quarter), the growth threat of a “No Deal” Brexit threatens to impose significant tariffs on Irish exporters entering the UK.

The positive news is that at least agreement has been secured in relation to the UK’s continuation as a “landbridge” to the EU with the agreement of the UK government to create “green lanes” of transport for Irish produce en route to elsewhere. But there is no doubt that diversification from dependance on UK markets is and will continue to be a priority. Thankfully, the world is a big place.

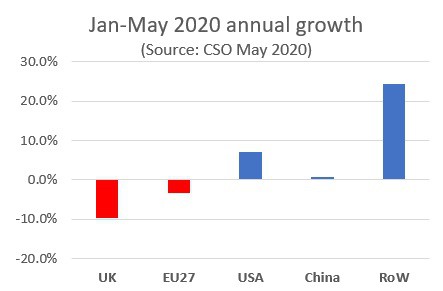

The fall in exports to the UK in the first five months of this year compared to the same period last year partly reflects a conscious decision by Irish food exporters to diversify away from that market.

The fall in exports to the UK in the first five months of this year compared to the same period last year partly reflects a conscious decision by Irish food exporters to diversify away from that market.

It is still the case, however, that the UK absorbs one third of Irish food exports. The positive news is that this proportion is now matched by exports to the EU 27 as a whole. A caveat to this is that due to weak demand conditions, exports to this region also fell in the period considered, albeit at a more modest rate.

Food exports to the US rose, however, as did – very modestly – exports to China. The weakness of the latter increase reflects anxiety and controls on food imports implemented by Chinese authorities. In the rest of the world Irish food exports recorded a very impressive 24 per cent increase. Proactive measures and diplomatic engagement can hopefully restore growth in China to the high rates seen until recently.

A proactive business development and promotion effort by Team Ireland can also target growth in key demographics and areas of the EU. Germany, in particular, offers huge potential in a highly ecologically conscious market for Irish food exporters needing to switch from the UK. Asia’s potential for exporting is vast. And Africa’s potential for strategic, sustainable food production is exciting.

At the end of a dark tunnel, Ireland’s ability to feed the world shines like a bright green light.