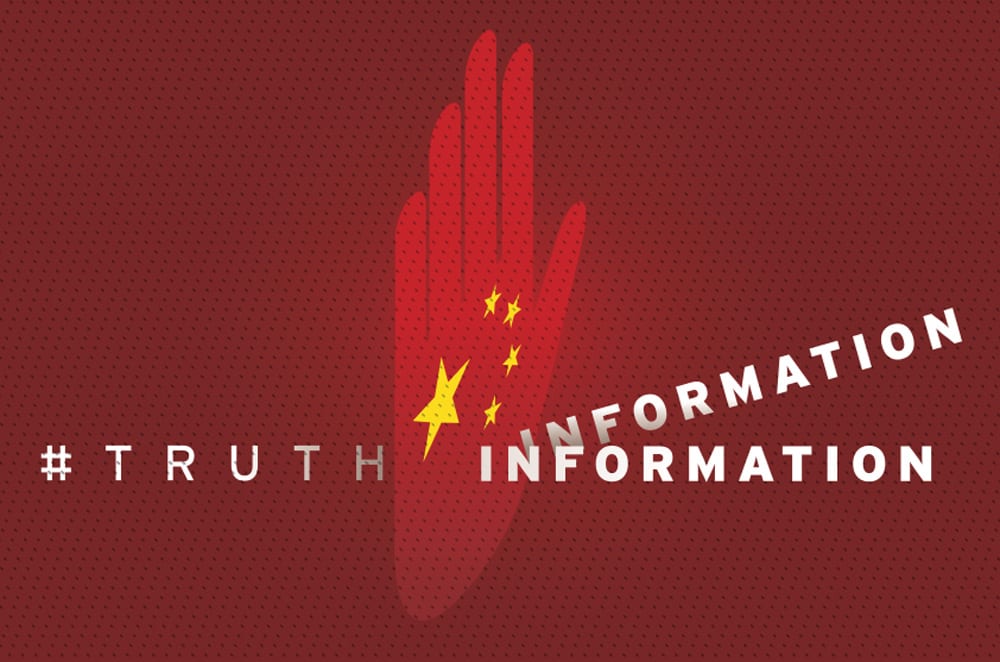

Figuring out fraud in China just got harder as authorities clamp down on information flow, writes Mark Godfrey.

China’s model of statist-cum-crony capitalism has bred plenty of corporate fraud. In a country where information disclosure is often prevented or prolonged due to the corporate interests of secretive Communist officials.

So secretive in fact that a respected British fraud and due diligence investigator has just been jailed. Plenty of eyes were on a courtroom in Shanghai in early August when a Chinese judge decided the fate of one of the most prominent investigators of fraud in China. The trial of Peter Humphreys and his wife Yu Yingzheng follows a year of imprisonment for the two, who founded ChinaWhys, a Shanghai and Hong Kong-based firm that performed due diligence, credit checks (as well as investigations of staff for possible kickbacks or embezzlement) for western corporations in China, among them British pharmaceutical firm GlaxoSmithKline Plc – itself the focus of an investigation by Chinese authorities who claim the firm paid kickbacks to drive sales in China.

The ChinaWhys duo were jailed for ‘illegally acquiring information’. This charge comes under a little-understood regulation introduced in 2009, known as Article 253 of China’s Criminal Law where it makes it illegal for government employees to trade information and data on individuals, and it also holds buyers of that information criminally accountable.

Article 253 was followed up by a raft of measures in 2012 when China began to crack down on social media and so-called ‘rumour mongering’.

April 2012 saw the beginning of a crackdown by police on private investigation outfits which have sprung up around China to root out corporate fraud as law firms outsourced investigations to well-connected local outfits, many of them set up by former Chinese police.

Data release

Part of the crackdown includes a limit on data releases by China’s corporate registry. China doesn’t have a national corporate registry like the central Companies House/Office in Ireland and in the UK. Rather the system is organised around the State Administration for Industry and Commerce (SAIC) and its autonomous provincial bureaus which file corporate data.

To get the details of a company’s shareholding structure and other data, a qualified Chinese lawyer was required to do an on-site search at the relevant SAIC office. From early 2012, the SAIC began to restrict the amount of data allowed to be released. It appears that the squeeze on information has varied according to regions, with some provincial SAIC offices more liberal with information than others. The move was seen at the time as a response to revelations about fortunes amassed by the families of former premier Wen Jiabao and current president Xi Jinping which were published by western media drawing on sources such as SAIC documents and stock filings.

The 2012 information crackdown also extended to a shut down of a cottage industry of private investigators which had sprung up to service corporates, many of them run by retired police officers. “In effect, ex-cops were paying their colleagues for information. In many cases, this information was annoying corporates with connections to local officials so the crackdown was inevitable,” says a Beijing-based ex-police officer, who himself ran a private investigation firm which he last year resigned from.

Investigations and disclosure

Corporate investigations have proven lucrative for police officers who are often amenable to exchange data for cash. It’s not unusual for police in China to profit from activities which are technically illegal, explains the retired cop: “Another of my former colleagues runs two unofficial currency exchange booths in the business district, he does it because he knows his serving colleagues won’t intervene.”

Even though outfits like ChinaWhys and local counterparts theoretically do a service in support of Xi Jinping’s anti-corruption drive, it’s clear that private sleuths worry the China Communist Party, which still prefers to investigate its own and remain above the law. Unpredictable exposes and disclosures hurt the image of the Party and they hurt the Party’s image in the public eye, and that’s why they cracked down, explained a Shanghai-based employee at a large multinational corporate risk advisory. Like many of those approached for this article, he declined to go on the record explaining this is a ‘sensitive’ time for his industry in China.

He explains another reason for squeezing access to data relates to a wave of Chinese listings in North America which turned up a wave of fraudulent firms, among them SinoForest which was successfully targeted by US short sellers. The ability of foreign-run research firms to gather and use data for short sellers and hedge fund clients ended up being a deep source of annoyance and embarrassment for Chinese regulators, especially the Securities Regulatory Commission.

The risk advisory executive explains: “Even though it wasn’t on their patch the revelations of fraud made it look like all Chinese stocks are dodgy and it led to a depression in stock market values just at the time when the government here was trying to get the market moving again.”

More information is better as a way to dispel unfounded allegations about Chinese companies.”

It’s not known for certain if ChinaWhys worked for hedge funds but sources say the firm and similar local peers had done much legwork in investigating the local operations of Chinese firms listed overseas. “They were the guys sitting outside factories and going to local banks and police stations for data on the individuals involved in these firms,” said a source at a European business consultancy with offices in Beijing and Tianjin.

From talking to locally-based businessmen and consultants it’s clear that AIC filings had in fact been surprisingly open and useful. Some of the provincial AICs encourage firms to lodge as many documents as possible so that prospective investors will go ahead with investments.

One consultant talks of a treasure trove of documents in one case which allowed him to ascertain who exactly controlled the Chinese firm his clients was seeking to enter a partnership with. “Ultimately the deal didn’t happen because one of the relationships the firm had didn’t work. The client had had a bad experience with that firm in another deal, but we were surprised at the level of data that was there was in some ways better than the kind of disclosure you’d get from company records offices in the west.”

Restricting access

Chinese authorities will likely be limited in how much they can restrict access to corporate information. The short-selling and scandals may have damaged Chinese stocks but they’ll be further damaged if investors can’t get access to the data to confirm their numbers. “The government has decided to restrict information, but more information is better as a way to dispel unfounded allegations about Chinese companies,” argues Beijing-based corporate lawyer Stan Abrams.

It’s not often appreciated that Chinese local government ‘trading offices’ charge for data and research. A government official in Chongqing explained how she moonlights for UK research outfits. “I just call up my colleagues and say this is for my little sister’s academic work and I get the data fairly conveniently.”

One of the weak links is China’s legal system. Prospective investors in other jurisdictions feel a lot more comfortable entering a deal given they can turn to a reliable court system to demand more documents. The court system in China is less predictable.

Information squeeze

In the current atmosphere there is another fear that government will further squeeze the information flow by deliberately interpreting corporate data as state secrets and prosecute consultants or advisors found with the data.

“This is especially a worry when you’re doing due diligence on state-owned firms,” explains Russell Brown, principal at Lehman Brown, an accounting firm in Beijing servicing multinational clients. “But it’s also a worry for accountants that audit documents will be interpreted as being state secrets.”

Meanwhile, there are hopeful signs that a slowing economy is prompting China to be friendlier to private business, even making it easier to do checks on local business partners.

Part of the crackdown includes a limit on data releases by China’s corporate registry.”

In late February 2014, a web-based search engine, the Enterprise Credit Information Disclosure System was set up by the SAIC, allowing anonymous online searches of companies by typing a company’s name or SAIC registration number. But information will be more limited than before. Under the new system China is increasing access to ‘basic’ corporate and financial data, according to Brown.

Red tape and regulations

Continuing the theme, government in June rolled out the Administrative Measures on Approvals and Filing of Foreign Investment Projects, which cuts red tape for would-be investors. There’s also been an easing of regulations for private equity firms who invest in SME-sized Chinese firms.

Meanwhile, three micro credit companies will be allowed to access the central bank’s credit rating system, among them Shanghai Chang Cheng Micro Loan Co, as the country seeks to reboot the economy by coaxing private investors.

As China seeks to balance an information crackdown with revving up the economy, it will be interesting to see how the Shanghai courtroom proceeds with the ChinaWhys case. In the meantime, China’s due diligence and fraud investigators are clearly keeping their heads down. Clients will have to do their own field work.

“Do your due diligence the old fashioned way,” says Beijing-based business lawyer, Dan Harris. He suggests firms ask for tax records and official documents from prospective Chinese partners as “legitimate companies won’t balk at that”. But this being China, be mindful of fake documents, he warns. Likewise, he advises clients to visit the offices and factories of local partners and to do a Chinese language web search on the firm. “Also, talk to the competitors,” he concludes.