Pictured from left: T.K. Whitaker and Marc Coleman

Marc Coleman, economist and founder of Octavian Consulting, believes fiscal policy holds the key to the Covid-19 response.

One of my favourite pieces of wisdom is contained in the saying “Whether you think you are going to succeed, or whether you think you are going to fail, you are probably right”. The crisis of 2008 created a cottage industry of books peddling retrospective negativity and despair. I was going the other way having predicted the crisis clearly (with some others) as Irish Times Economics Editor in an article on July 6th 2006. But I was equally certain it would be followed by recovery and wrote a book to that effect in 2008. Following an avalanche of criticism, I doubled down and produced another book with the same message (Back from the Brink, 2009). However, we did recover and given our open economy and small size we can, through clever diversification both geographic and sectoral, do so again.

Whether you think you are going to succeed, or whether you think you are going to fail, you are probably right.

The last time, recovery should not have taken so long. It was prolonged by incorrect fiscal adjustment and excessive negativity. As T.K. Whitaker, who endorsed my first book, pointed out to me, the mood of the country and investors is a key determinant of recovery. So negative was the prevailing mood that in 2010 I organised a “Confidence in Action” event with then Finance Minister and leading media figures to re-balance the narrative.

We cannot control world events. We can, however, control our response. To parallel rigorous action to contain the Covid-19 virus, Octavian Economics is producing both a weekly bulletin and, soon, an economic plan, distilling the insights of four books written on our last recovery.

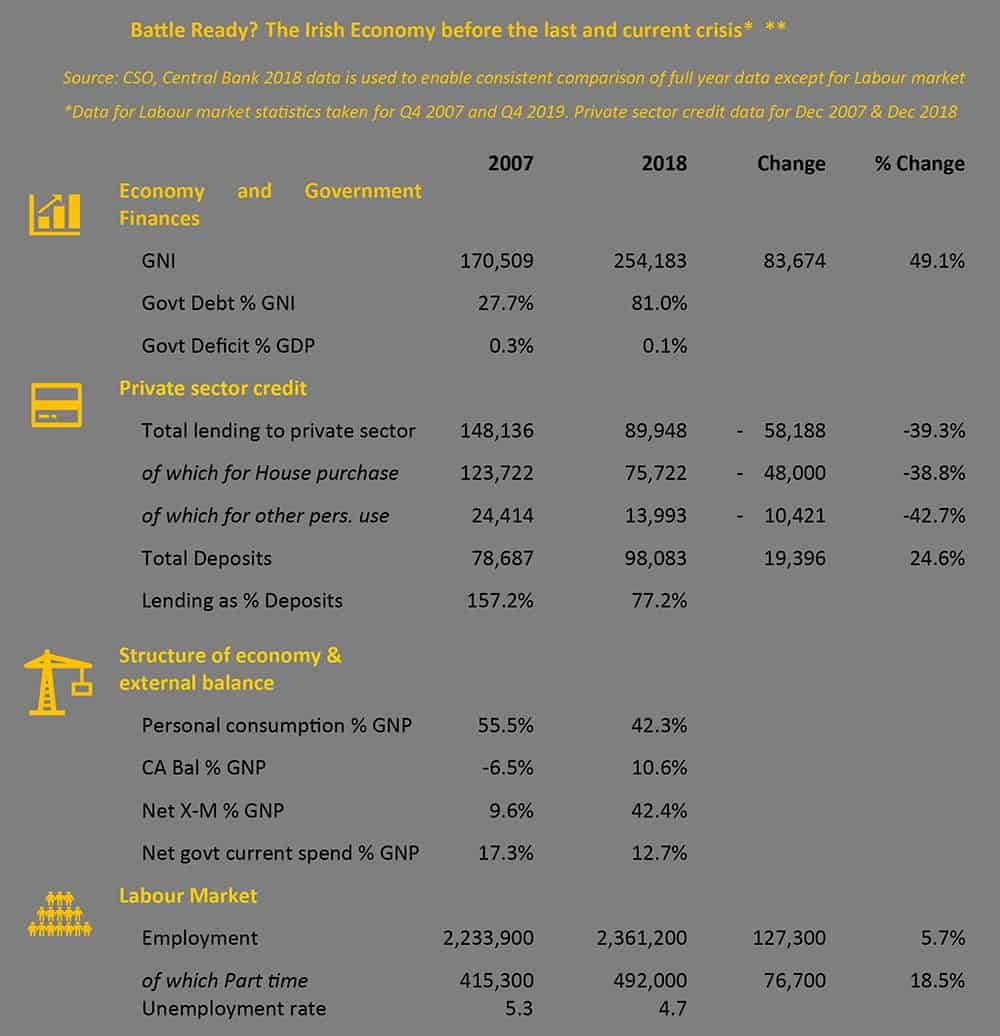

The good news is that our economy now is much more diversified than in 2007. This matters hugely. The external economy recovered rapidly from 2009 but overall recovery was held up by relentless tax rises. From 9.6% in 2007, net exports are now over 40% of GNP. Personal debt, while still a huge human problem (as reported recently by Tasc), is much less of a macroeconomic one. From almost nearing the Gross National Income (GNI, a more appropriate measure for debt), personal lending is now around one third of GNI.

The Irish Economy before the last and current crisis

Unfortunately Government debt is much higher at 80 per cent of GNI compared to approximately one quarter in 2007. Government’s contribution to the economy, 12 per cent of GNI in net terms, is less now than back then (17 per cent) implying scope to increase the role of government in the economy. But how is the question. As the Children’s hospital saga shows, we need to fix the hole in the bucket before we pour in more water. And contrary to prevailing narrative, tax cuts may be crucial in stimulating a private sector where the vast majority if not all the job losses will occur. We must also ensure that policy making adequately represents the real private sector and risk takers in our economy as they are set to bear the burden of job loss.

As the Children’s hospital saga shows, we need to fix the hole in the bucket before we pour in more water. And contrary to prevailing narrative, tax cuts may be crucial in stimulating a private sector where the vast majority if not all the job losses will occur.

At one conference planned on SME funding for instance, only one out of 13 speakers (7 per cent) were from the private sector and only 7 per cent of recruits at the top of the public sector in 2017 came from the private sector. This “7 per cent” problem must be rectified as soon as possible. The last election has shown us what happens when significant groups of voters feel underrepresented and marginalised.

But our key challenge is to get around the biggest problem of all, namely the lack of fiscal room for manoeuvre due to higher public debt. In 2014 I made the case for relief of Ireland’s IMF debt to senior economists at the ECB where, a decade previously, I had worked in the Fiscal policy division. In a 2013 book co-authored with the German Irish Chamber “Ireland and Germany Partners in European Recovery” I noted how the European Council’s agreement to the Single Resolution Mechanism effectively agreed the principle of a “bail in”.

With a significant portion of our higher debt emanating from the liquidation of the IBRC, and with a dire emergency at hand, we need to put this issue and/or Fiscal Treaty flexibility (preemptive rather than waiting until it’s too late) on the table.

For Coleman’s weekly updates see Businessandfinance.com