In this week’s review of the markets, Ian Slattery reports on US interest rates and GDP estimates.

Ian Slattery, Investment Communications, Zurich Life

All eyes were on the FOMC meeting on Wednesday as the Fed announced it would keep interest rates unchanged while closely monitoring inflation. The Fed had previously delivered three rate hikes since December but instead signalled an imminent Balance Sheet reduction.

In the US GDP estimate figures were released last week showing an expansion of 2.6%, slightly lower than expectations. Europe will be releasing its own preliminary Q2 GDP figures today.

Oil had its best week of the year so far as it rose 8.6% and was on pace to set a two month high going into the end of the week.

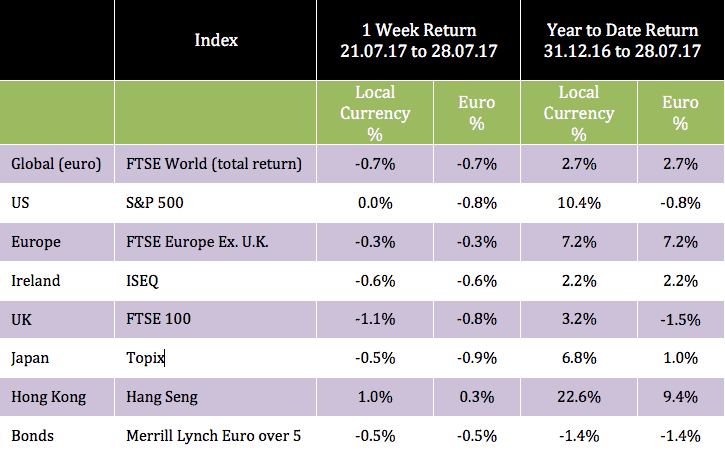

The global index returned -0.7% for the week as the stronger euro continues to negate local currency gains. Commodities continued on from last week enjoying another positive week, as Gold (+1.2%) and Copper (+5.6%) closed higher. Oil however was the prominent force as it rose by 8.6% on the back of an OPEC producers meeting.

In the US GDP estimates figures were released last week showing an expansion of 2.6%

US 10 year Treasuries prices fell, with the yield (which moves inversely to price) rising to 2.29%, from 2.24% a week previously.

THE WEEK AHEAD

Monday 31st July

The Eurozone market inflation figures were released on Monday morning by the EU. Inflation in the Eurozone has managed to remain below the ECB’s target in recent times, and stayed constant with the previous month’s figure at 1.3%.

Thursday 3rd August

The Bank of England will meet on Thursday to decide on its monetary policy where it is widely expected they keep rates the same.

The team at Zurich Investments is a long established and highly experienced team of investment managers who manage approximately €13bn in investment assets and have a reputation for delivering consistent performance. To find out more about Zurich Life’s funds and investments, w: zurichlife.ie/funds t: @ZurichLife

l: linkedin.com/company/zurich-life-assurance-plc