Markets advance for third straight week on trade deal optimism, and with US earnings season about to start, all eyes will be on corporate America, writes Ian Slattery.

Ian Slattery

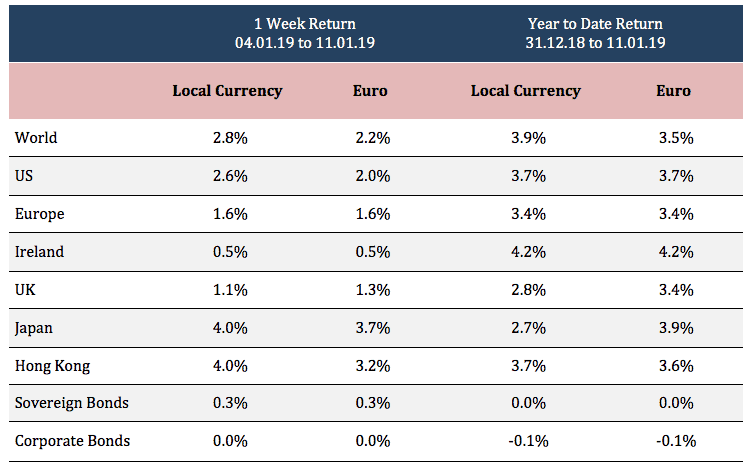

Volatility declined and stocks marched higher for the third straight week with international markets leading the way. The move comes on the back of renewed optimism that a trade deal between the US and China will be reached.

Although we are in the latter stages of an economic cycle, the US consumer is healthy and the broadly positive economic data suggests calls for an imminent recession are premature.

Meanwhile, comments from Federal Reserve Chairman Jerome Powell further allayed fears of aggressive rate hikes in 2019, with core inflation (ex food and energy) within the Feds range at 2.2%. In Europe, though, there were further signs of regional slowing as both French and German industrial production declined.

As for the week ahead, US earnings season kicks off and will give some indication into the health of corporate America, particularly on the back of some recent profit warnings.

Equities

The MSCI World Index advanced 2.8%, with all major markets advancing and Asian markets outperforming. Stocks in the US are now up 10.4% since their December low with volatility at its lowest in over a month.

Fixed Income & FX

The US 10-year yield ticked higher to 2.70% with the German yield at 0.24% as the bid for safehaven assets moderated. The EUR/USD advanced to 1.1471 but EUR/GBP declined to 0.893 as Brexit hopes fuelled a rally in the British pound.

Commodities

The rebound in oil prices continued with supply cuts and trade talk optimism taking centre stage, sending prices to $51.59. Gold moved marginally lower to $1,288 per troy ounce, while Copper prices ticked higher to $5,920.

THE WEEK AHEAD

Tuesday 15th January:

- French Core Price Inflation

- US Producer Prices Index

Wednesday 16th January:

- UK Consumer Price Index

- US Retail Sales Announcement

Thursday 17th January:

- US Housing Starts

- US Jobless Claims

The team at Zurich Investments is a long established and highly experienced team of investment managers who manage approximately €23.5bn in investments of which pension assets amount to €10.8bn. Find out more about Zurich Life’s funds and investments here.

w: zurichlife.ie/funds t: @ZurichLife

l: linkedin.com/company/zurich-life-assurance-plc