A vibrant mergers and acquisitions (M&A) scene emerged during 2015, with a significant rise in deal values, from €45.3bn in 2014 to €189bn in 2015.

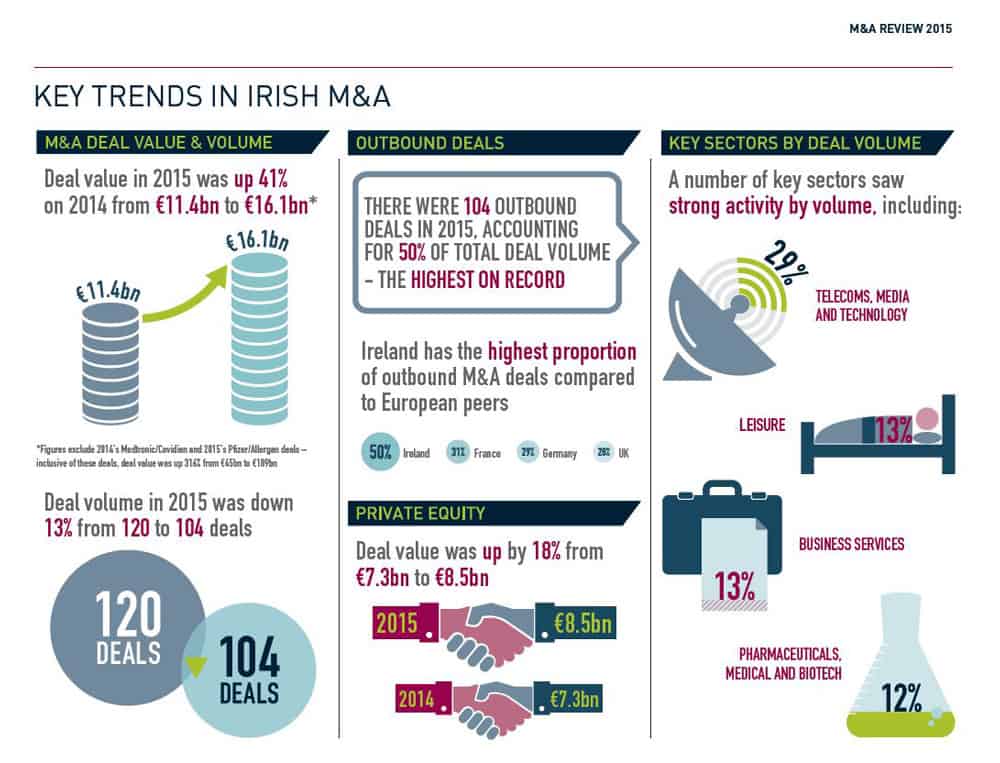

The fifth annual William Fry M&A Review found that, excluding the Pfizer acquisition of Allergan (€172.6bn), Ireland’s M&A sector still recorded a significant increase, with value up 41% on 2014, from €11.4bn to €16.1bn.

The largest deal being Bohai Leasing’s purchase of Avolon Holdings, for €6.5bn and the second largest the purchase of King Digital Entertainment by Activision Blizzard, for €5.3bn.

The most notable trend in 2015 is that half of all transactions with an Irish element were outbound, the highest on record for Irish businesses making overseas acquisitions and higher than recorded in other countries such as France, Germany and the UK.

Although outbound deals accounted for greater volume of transactions, inbound deals dominated by value, with nine out of 10 largest deals by value in 2015 involving foreign bidders – four from the US, three from Europe and two from Asia-Pacific.

Much of Ireland’s continued growth in M&A can be attributed to greater access and choice in source of finance, reflecting a return to more stable investment opportunities.

Deals in the property sector also continued to recover in 2015, recording 6% of overall volume, up from 3% in 2014 and the highest recorded since 2007.

Over 500 construction projects commenced last year and there were strong levels of investment, €3.7bn, in commercial property, including the much publicised sale of the Project Jewel portfolio by NAMA for €1.8bn.

The pharmaceutical, medical and biotech sector accounted for 12% of the volume of deals, although 92% of overall value as a result of the huge Pfizer/Allergan €172.6bn deal.

Shane O’Donnell, head of Corporate and M&A, William Fry, said: “2015 saw the highest ever level of outbound deals, showing Irish businesses are now strong and confident enough to grow their global footprint. We also saw a change in the mix of sectors recording deals, with technology, media and telecommunications dominating deal volume for the first time ever, reflecting the fast-paced evolution of these businesses and the opportunities being seized by mid-market sized firms to either grow through acquisition or to sell their business. This growth in deals has been encouraged by the easier access to affordable funding in 2015, largely driven by the ECB’s €1.1tn quantitative easing programme.”