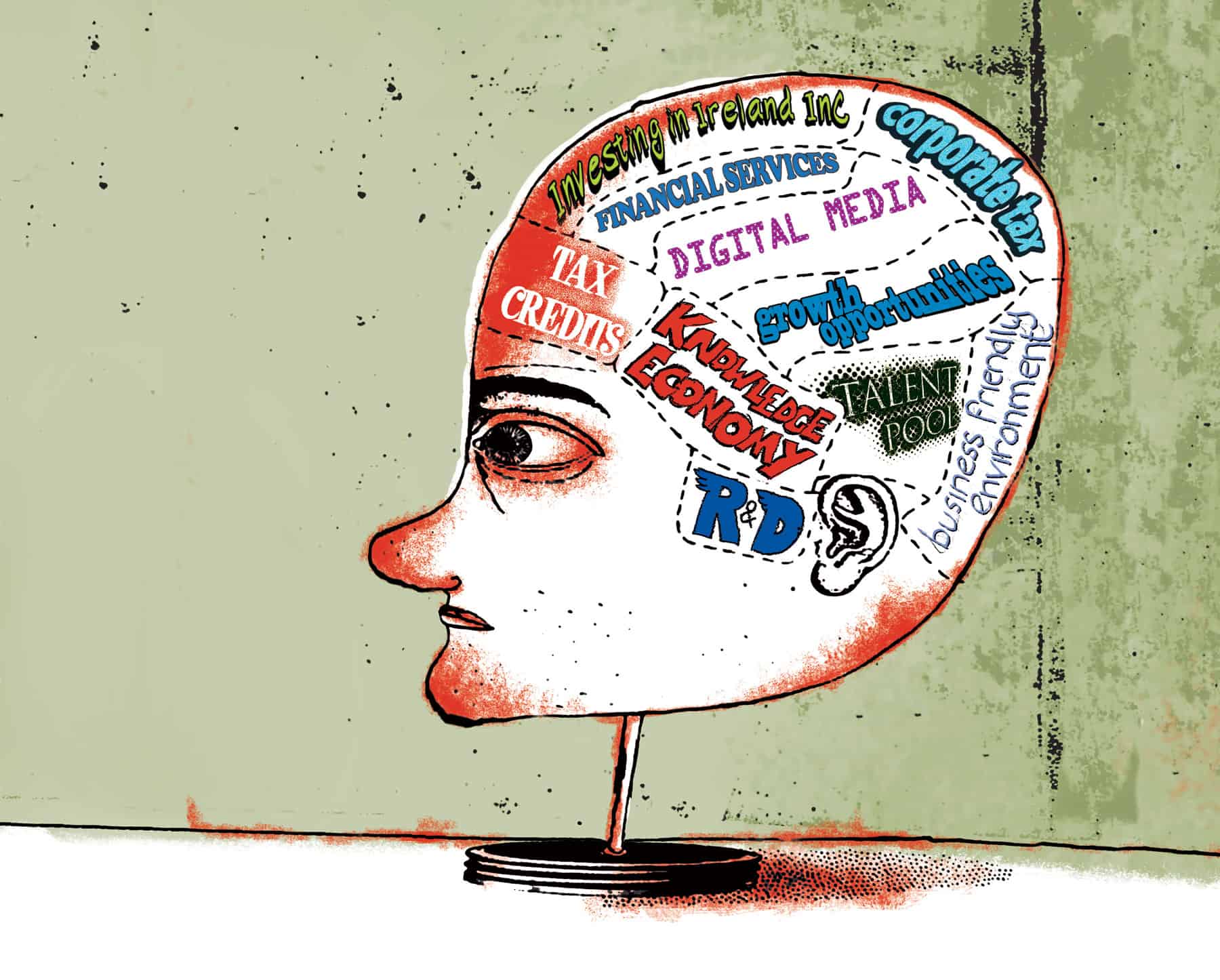

Ireland is using its growing status as a knowledge-based economy to open new doors and provide growth opportunities for investors.

The 2008-2012 Business Environment Ranking of the Economist Intelligence Unit, placed Ireland 11th globally out of 82 countries, naming it as one of the most attractive business locations in the world. Furthermore, Forbes 2011 named Ireland as the best country in Europe in which to do business.

Strategic location with easy access to the EMEA region, a thriving RD&I sector, with strong Government support for productive collaboration between industry and academia, and a strong legal framework for development, exploitation and protection of Intellectual Property (IP) rights, are all compelling reasons why international corporates are locating to Ireland. Add to this the fact that there are a number of clusters of leading global companies in life sciences, ICT, engineering, business services and digital media, and Ireland’s reputation as a competitive place to do business is further enhanced.

Willie Deese, executive vice president and president Merck manufacturing division, said on the opening of its new €100 million R&D centre in Tipperary: “The decision to locate a worldwide pharmaceutical R&D centre in Ballydine was due to a number of factors, chief among which was the credibility, track record and expertise of the Ballydine team, the technology and infrastructure at the site and the support we have received from the Irish Government and IDA Ireland.”

Partnership

As a knowledge-based economy, the message is clear to potential investors – Ireland is open for business. Ireland’s success in attracting foreign direct investment (FDI) has been due to collaboration between all stakeholders, including government agencies, industry, academia and regulatory authorities.

The corporate tax rate of 12.5%, a 25% R&D tax credit scheme, refundable over a three-year period, and an IP regime that provides a tax write-off for broadly defined IP acquisitions, is attracting investment. But these fundamental factors are not the only motivating reasons for global companies choosing Ireland as a destination for their European operations. In addition to the tax and regulator environment, Ireland is an attractive location for international corporates due to the highly skilled talent pool available.

Ireland’s young, highly educated workforce has seized the opportunity provided by foreign investment and continues to transform Ireland into a dynamic, competitive, knowledge-based economy.

Michael O’Dea, president and chief operating officer, JRI America, Inc. said on the announcement of its software development operation in Tralee: “We believe that Ireland offers our company a unique opportunity where there is not only strong government support for innovation and business, but also a deep pool of talented people with strong technical skills from which to build our team.”

Investor commitment

Multinational corporations that originally located here because of the low corporate tax and pro-business environment, have time and again, expanded their activities in Ireland because of the skilled Irish workforce.

This is evidenced by the number of significant job announcements in high value sectors and is further confirmation of global corporates continued commitment to invest in Ireland.

Recently, PayPal, the leading global online payments company, announced the creation of 1,000 jobs over the next four years at its new European operations in Dundalk, Co. Louth. The biggest jobs announcement in the last number of years, it is estimated that these jobs have the potential to generate an additional 3,000 spin-off jobs.

In the first month of 2012 alone, there was other good news on the jobs front. MasterCard Worldwide announced a new global office, headquartered in Dublin which will create an additional 130 highly skilled jobs over the next four years.

Accenture announced 100 skilled technology jobs to be filled over the next year and the Association of Chartered Certified Accountants (ACCA) predict the shared services sector will be a significant engine for FDI and has the potential to create jobs in a sector that already employs over 39,000 people in Ireland.

Eli Lilly, a global leader in biopharmaceuticals, is to invest €330m in a brand-new facility at its Kinsale campus in Cork. The investment will expand the Kinsale site’s existing biopharmaceutical mission with the establishment of an additional world-class commercialisation and manufacturing facility, and when fully operational, will require up to 200 highly skilled employees. In addition, a further 300 construction jobs will be created during building works.

Microsoft announced that it is investing an additional $130m to expand its data centre located in Dublin. This investment builds on the original $500m investment Microsoft has already made at its data centre, which provides computing capacity to customers across Europe, the Middle East and Africa.

“This investment shows where we are placing our bets for the future,” Peter Klein, chief financial officer, Microsoft said. As customers embrace Microsoft cloud services, we are investing in regional cloud infrastructure to meet their needs and are delighted to build on the long history of Microsoft investment and partnership in Ireland.”

Responding to this announcement, the Taoiseach, Enda Kenny said: “We very much recognise the role that cloud computing can play in transforming our public sector as well as being a catalyst for economic growth. Through the Action Plan on Jobs, we will continue to make the necessary changes to make Ireland more attractive to companies such as Microsoft.

Growth sectors

Other positive indications on the outlook for 2012 came from the medical technology industry, which saw investment plans worth over €170m and the creation of more than 875 jobs in 2011. The industry also revealed a new four-year plan to create more jobs and bring in more investment.

According to the Irish Medical Device Association (IMDA), med tech companies in Ireland export €7.2bn worth of products annually and employ 25,000 people – the highest number of people working in the industry in any country in Europe, per head of population.

Recent reports published by IBEC show that during 2012, approximately half of all medical technology companies in Ireland expect to recruit additional employees and two thirds expect turnover to increase during the next five years. The ongoing investment and job creation reflects the vibrancy of the medical technology sector in Ireland, according to Paraic Curtis, chairman of the IMDA. “The investment of €170m is across a wide range of development, manufacturing and R&D projects. 2012 has started brightly.”

Funds industry

In respect of the funds industry, Ireland experienced the highest net inflows of UCITS of all fund domiciles in 2011 attracting some €62 billion – almost €50bn more than the next most successful domicile. In fact, Ireland attracted nearly twice as much as all the other jurisdictions put together during 2011 and experienced growth of 8%.

The annual statistical report, Trends in the UCITS Market, from the European Fund and Asset Management Association (Efama) revealed that Ireland bucked the trend with most domiciles actually facing significant outflows of UCITS during 2011. France, Italy and Luxembourg suffered the biggest losses.

In the fourth quarter alone, Ireland attracted an impressive €26bn in new monies. Gains by only four other domiciles were considerably less at €3bn, €1bn, €1bn and less than €1bn.

These figures mean that Ireland continues to be the fastest growing UCITS domicile in the world and is rapidly outpacing all other domiciles in terms of growth. Over the past 11 years, the net assets of Irish UCITS have grown more than 500% and Ireland’s UCITS market share has increased to 14.5% from 11.5% at the beginning of 2011, according to Efama.

Ken Owens, chairman of the Irish Funds Industry Association, said: “These figures demonstrate Ireland is rapidly growing its share of UCITS. This also emphasises that Ireland is able to provide all the solutions to the international funds industry whether in the retail or alternative sector.”

Owens added: “We expect, that as the world moves to embrace further regulation such as AIFMD and FATCA, that Ireland will continue to be the natural choice for fund managers. This will largely be as a result of Ireland’s robust regulation; its regulation-ready product solutions with a proven track record and widest distribution capabilities; and its open environment with information exchange agreements in all of its tax treaties and a policy of cooperating in matters of tax transparency.”

Team Ireland

Given the economic challenges Ireland has endured in the past few years, and considering the constant need to remain competitive, Ireland is performing well and is on course to maximise on global investment opportunities.

According to Barry O’Leary, CEO, IDA Ireland: “In a world where Ireland faces new and growing competitive threats every year for our share of FDI, resting on our laurels will guarantee only failure.” Success he says will require an unprecedented level of collaboration from all stakeholders in the Irish system to continuously adapt.

“Government, IDA and our sister agencies, universities, current multinationals and indigenous entrepreneurs – we call that group Team Ireland,” he points out. “If our past success was built on a world-leading proposition combining our track record, talent, tax regime and technology, our future depends on our ability to add transformation to the list of things at which Team Ireland excels.”

*This article was originally published in Doing Business in Ireland 2012.