Trade tensions between the US and China continued, global equities declined and bonds experienced some pressure, writes Ian Slattery in his latest market update.

Ian Slattery

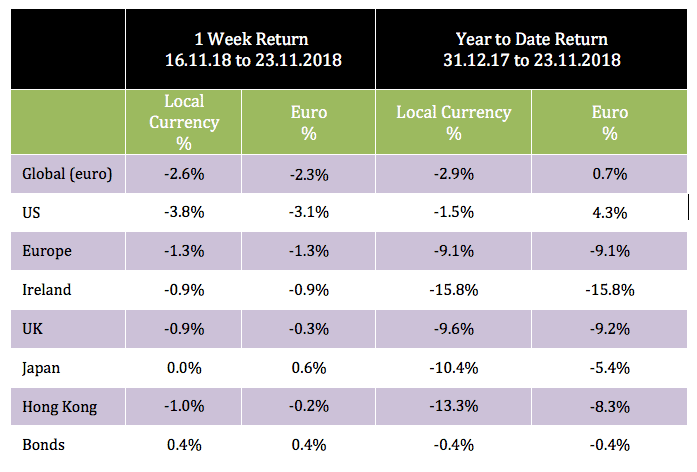

Global equities declined but are still showing gains in euro terms year-to-date (+0.7%). Value stocks outperformed growth stocks in the US for the fourth consecutive week, with internet and technology shares amongst the hardest hit.

On the economic front, trade tensions between the US and China continued to weigh on sentiment, as did the rise in US weekly jobless claims and a decline in consumer sentiment. However, existing home sales in the US did increase more than expected.

Corporate bonds were once again under pressure, particularly in the high yield sector, where energy is a large segment of the market.

The global equity index declined 2.3% in euro terms last week, led lower by weakness in US tech stocks.

Oil prices continued to slide, slumping to just over $50 /barrel as supply issues remain the primary concern. Gold ended marginally higher at $1,223 per troy ounce, while Copper also finished the weak higher at $6,237 per metric tonne.

Despite weaker equity and commodity markets, investors did not retreat to safe haven assets as much as might have been expected. The ten year US bond yield only slightly declined to 3.04%, while the German equivalent moved lower to finish at 0.34%.

The EUR/USD rate ended the week at 1.134, with the EUR/GBP at 0.885.

THE WEEK AHEAD

Wednesday 28th November:

US GDP is expected to come in at 3.5% annualised, with consumer spending rising to 3.7%, below the previous estimates for 4%. New home sales are forecast to rise sharply to 575k, after a weak reading of 553k in September.

Thursday 29th November:

EU economic sentiment is forecast to remain relatively unchanged at 109.4, with consumer prices in Germany rising to 0.2% m-m from the previous reading of 0.1%. The consensus range for US jobless claims in 210-228k.

Friday 30th November:

The flash harmonised CPI (HCPI) figure for the Eurozone is predicted to decline from 2.2% to 2% y-y. Meanwhile, the French HCPI is forecast to come in at -0.2%, considerably lower than the previous reading of 0.1%.

The team at Zurich Investments is a long established and highly experienced team of investment managers who manage approximately €23.5bn in investments of which pension assets amount to €10.8bn. Find out more about Zurich Life’s funds and investments here.

w: zurichlife.ie/funds t: @ZurichLife

l: linkedin.com/company/zurich-life-assurance-plc