Ian Slattery looks at investments to see what the key drivers are and finds the markets were broadly flat as Jackson Hole provides little new news.

Ian Slattery

Typically light late summer trading volumes and a scarcity of economic releases meant equity markets once more took their lead from geopolitical events, as fading US-North Korea tensions were countered by the continued focus on the US debt ceiling, which could potentially pitch the Trump administration against Congress.

Fading US-North Korea tensions were countered by the continued focus on the US debt ceiling

There was little new information forthcoming from the Fed conference at Jackson Hole, which saw keynote speeches from the Central Bank heads of the US, Japan, and eurozone. Fed Chair Yellen gave little for investors to chew over whilst ECB President Mario Draghi reiterated the commitment to a slow removal of monetary stimulus. However, the euro currency subsequently hit a two and a half year high versus the US dollar as strong PMI data released last week added to the sentiment that the eurozone economy is on an improving growth trajectory.

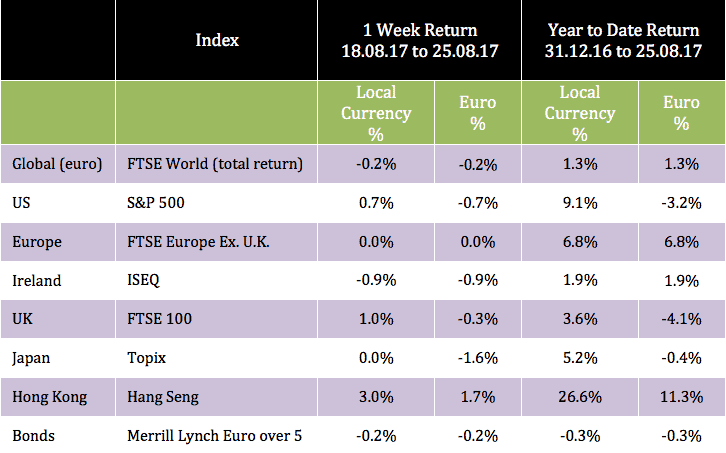

The global index moved lower last week, down 0.2% as the stronger euro reduced returns for Irish investors.

European Sovereign Bonds had a negative week with the Merrill Lynch over 5 year index returning -0.2%, and has now returned -0.3% year-to-date.

Gold was positive over the course of the period, returning 0.6%. Oil saw a negative week, returning -1.3% to finish at $47.87. Copper continued to move higher, returning 3.2%. The industrial metal is now up an impressive 21.4% year-to-date.

The influential EUR/USD rate closed at $1.19, whilst EUR/GBP was at 0.85.

This week

Wednesday 30th August

The second estimate of Q2 US GDP is released and is expected to tick up to 2.7% (quarter-on-quarter) from the last reading of 2.6%.

Thursday 31st August

Flash eurozone inflation figures for August are released and an increase to 1.5% (year-on-year) from the last reading of 1.3% is the consensus estimate.

Friday 1st September

August’s US employment report goes to print where the expectation is for non-farm payrolls to increase by 180,000 (last 209,000) whilst the unemployment rate is forecast to remain steady at 4.3%.

The team at Zurich Investments is a long established and highly experienced team of investment managers who manage approximately €21.5bn in investment assets and have a reputation for delivering consistent performance. To find out more about Zurich Life’s funds and investments, w: zurichlife.ie/funds t: @ZurichLife

l: linkedin.com/company/zurich-life-assurance-plc