Trump’s rhetoric ensures a tough week for the markets and it’s a waiting game to see if China will retaliate, writes Ian Slattery.

Ian Slattery

The US Administration’s China trade war heated up last week. And the market waits to see if China will retaliate should the US continue to impose tariffs on Chinese imports which could have the potential for a closer move into a potential lose-lose trade war scenario.

With World Cup 2018 in full swing, a positive for Russia is that it might generate $1.5 billion to $2 billion in FX inflows

While the direct economic effect of current US tariffs on $50 billion worth of Chinese goods is manageable, the actual negative impact on the economy would be bigger, such as delayed investment arising from uncertainty associated with the potential further trade.

With World Cup 2018 in full swing, a positive for Russia is that it might generate $1.5 billion to $2 billion in FX inflows, which can support the RUB during a vulnerable period of adverse seasonality. World Cup-related spending might support consumer indicators and potentially add 15-20bp to the 2Q18-3Q18 GDP.

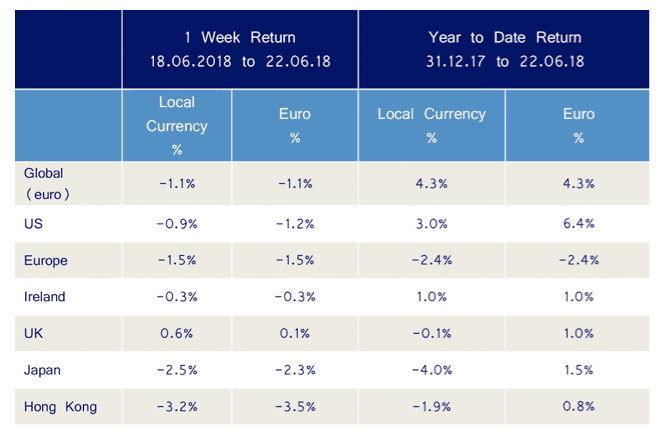

Global equities suffered a testing week with most major markets experiencing falls. Overall, the picture was a -1.1% fall for World Equities with Far East stocks posting the largest falls (Japan -2.5% and Hong Kong – 3.2% in local currency terms).

Year to date the picture is still positive as we come to the end of the half year with global equities up over 4%. Commodities were a mixed bag with oil up over 5% for the week but gold and copper both fell (-0.8% and -3.7%, respectively).

The team at Zurich Investments is a long-established and highly-experienced team of investment managers who manage approximately €22.1bn in investment of which pension assets amount to €10.1bn. To find out more about Zurich Life’s funds and investments, w: zurichlife.ie/funds t: @ZurichLife

l: linkedin.com/company/zurich-life-assurance-plc