The markets experienced some volatility against a challenging political backdrop and trade tariffs are likely to dominate at the G7 Summit in Quebec, writes Ian Slattery.

Italian political developments dominated markets last week, as negotiations traded back and forth between the coalition government and the President.

Ian Slattery

Risk dissipated somewhat later in the week, as a more moderate Finance Minister was proposed. However, volatility flared in Spain as Prime Minister Rajoy was ousted in a no-confidence vote.

Trade tensions also flared as no eleventh hour trade deal materialised in relation to steel and aluminium tariffs on US imports from EU, Canada, and Mexico – and will be sure to be a key talking point as the G7 meets later in the week.

However, US stocks got a boost from a better-than-expected May jobs report with 223,000 jobs added, much higher than the 12 month average of 191,000. Unemployment also edged down to an 18 year low of 3.8%.

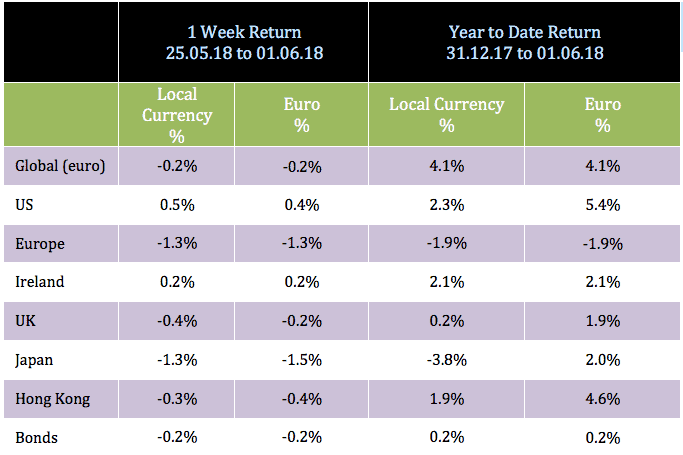

The global index closed lower last week, as negative price action in Europe offset gains in the US.

Commodities were broadly lower for the period as oil fell for the second week in a row, on the back of rising US output. Copper bucked the trend and was up 0.7% in dollar terms.

The 10 year US bond yield finished the week at 2.90% from 2.93% as prices (which move inversely to yields) rose, on the back of risk aversion early in the week, although these gains were partly erased by the good economic data releases on Friday. The EUR/USD rate finished at 1.17, whilst EUR/GBP was at 0.87.

THE WEEK AHEAD

Tuesday 5 June

UK Services PMI data goes to print, where the consensus expects the index to edge up slightly to 52.9 from 52.8.

Thursday 7 June

There is no change forecast as the final eurozone GDP data for Q1 is released, with the quarter-on-quarter growth rate to be confirmed at 0.4%.

Friday 8 – Saturday 9 June

Trade tariffs are likely to dominate at the G7 Summit in Quebec, with US Commerce Secretary Wilbur Ross to face some tough questions from his peers.

The team at Zurich Investments is a long-established and highly-experienced team of investment managers who manage approximately €22.4bn in investment of which pension assets amount to €10.1bn. To find out more about Zurich Life’s funds and investments, w: zurichlife.ie/funds t: @ZurichLife

l: linkedin.com/company/zurich-life-assurance-plc