Pictured: Marc Coleman, economist and founder of Octavian Consulting

Marc Coleman, economist and founder of Octavian Consulting, discusses Ireland’s plan to step out of lockdown, and how government supports for business might work in a period of economic uncertainty

At last, a timetable. At last, a significant package of business supports. The May bank holiday produced not just sunshine, but also hope. But is the announced wind-down of the lockdown coming fast enough? And is the package of supports – some €6.5 billion for business (less for SMEs) – extensive enough?

Let us deal with the wind-down timeline first. In Israel – arguably a country that was ahead of the curve – the response to the crisis was not just rapid (measures began in January), but very tech-focused with a downloadable app made available to citizens, and a highly innovative approach to testing and tracing. As a result, Israel’s wind down is much faster and its economy recovering more quickly, despite a similarly uncertain government situation to our own. In early April, in a technical briefing note, I urged that a similar approach be adopted here so that the lockdown could be ended as quickly as possible. Ireland, like Germany, has been exemplary in the discipline of its lockdown. The question now is whether the lockdown could have been shorter and could have ended more quickly.

These questions are crucial to recovery. Having started in mid-March, the lockdown is now going to be wound down over a period that will last effectively until September, 6 months after it began.

Now bear in mind that government forecasts in the latest Stability Update – which suggest 10-11 per cent economic decline, 14 per cent unemployment and a deficit of €23 billion – the lockdown’s economic impact is “bottoming out” this quarter (likewise, Central Bank of Ireland and ESRI forecasts). With a more graduated lockdown economic momentum – which is key to recovery – this will be more difficult to sustain into the summer break, and it could take until the third quarter before the domestic economy “bottoms out”.

We are dealing not just with “first round” domestic retail and service economy impacts, but looming “second round” effects as recession in our trading partners heads our way. At 4.8 per cent and 3.5 per cent respectively, US and EU economies have already reported dramatic falls in economic output for the first quarter, particularly dramatic as the lockdown only kicked in for the last half of March. Second quarter declines in those economies will be daunting, and it is in the third quarter – just as our domestic economy emerges from lockdown fully – that they will impact on us.

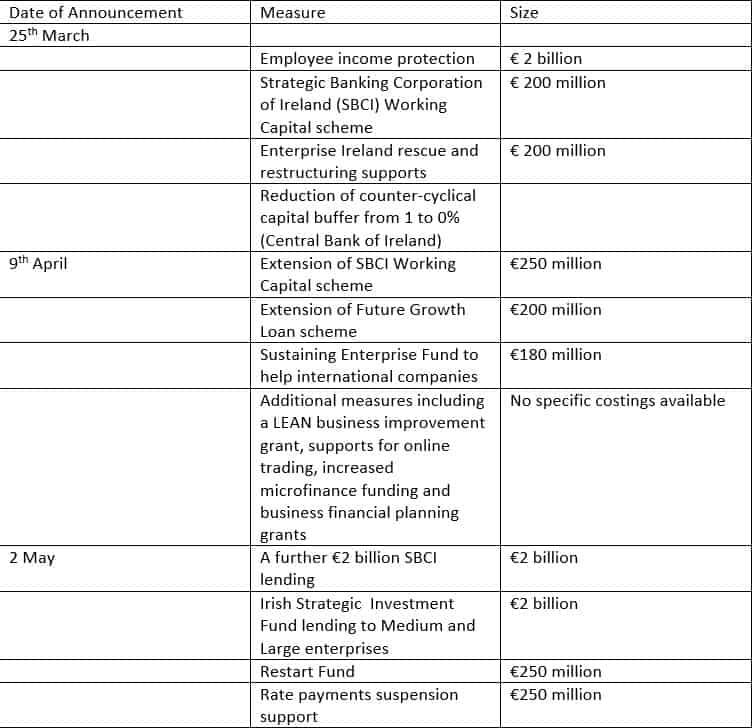

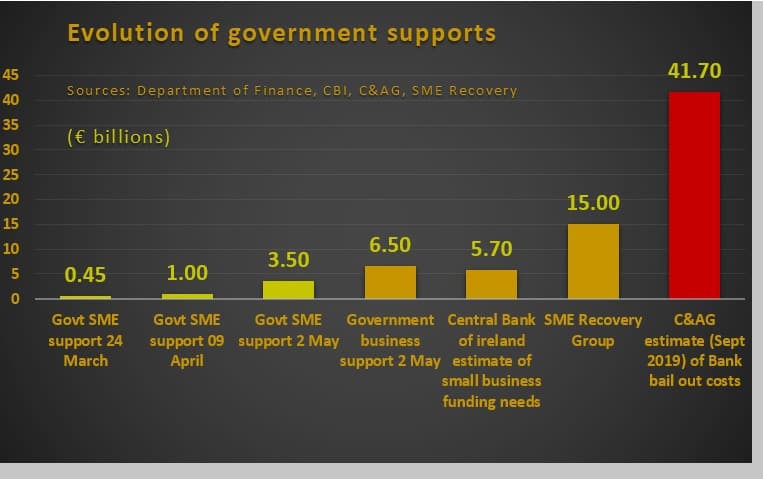

Which brings us to the second question: Figure 1 outlines the welcome measures introduced to date. Figure 2 contrasts the total amounts announced on specific dates (25th March, 9th April and 2nd May) with Central Bank of Ireland estimates and with two other metrics.

Figure 1: Measures introduced by Irish Government to support business in Covid-19 crisis

Firstly, on 5th May the SME Recovery group called for the implementation of a comprehensive programme of supports totaling €15 billion. Secondly, last September the Comptroller and Auditor General estimated the net cost of Ireland’s bank bail out at €41.7 billion. Given the unprecedented gravity of this crisis – in two months our economy has exceeded the worst unemployment levels of the last crisis – and the fact that the small business sector accounts for two thirds of employment and tax revenues, using this benchmark is arguably not an exaggeration.

All measures announced to date to support business should be welcome, as should Ireland’s exemplary leadership in tackling the medical aspect of the crisis, relative to other EU states. But clearly given the awesome gravity of this crisis, the interim and incremental steps announced in the last six weeks, while welcome, can only be steps to a comprehensive and fully fledged business – and specifically SME – survival plan to be implemented when a new government takes office.

Figure 2: Evolution of government supports for business sectors