Equities higher on the back of US midterm election results and the European Commission warns that Eurozone growth will slow due to trade worries and higher oil prices. Ian Slattery reports.

Ian Slattery

The S&P 500 recorded its third-best daily gain over the past year last Wednesday after Democrats took control of the House and Republicans secured the Senate. Health care stocks outperformed with communication services stocks weighing.

The US Fed kept their federal funds target at 2%-2.25%, citing strength in the labour market and solid economic activity. They also reaffirmed their plans to continue raising rates gradually. The ISM Non-Manufacturing PMI fell to 60.3, but general growth in the services sector remains solid.

The European Commission said that Eurozone growth would slow through 2020, pressured by trade worries, high oil prices and uncertainty. Italian debt came under added pressure as the EU warned Italy it is poised to breach the EU’s budget deficit limit in 2020 if the government continues with its spending plans.

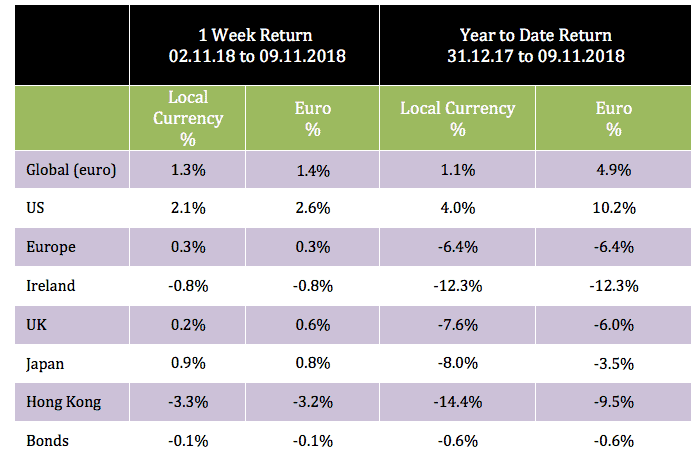

The global index was up 1.4% in euro terms last week, led by large cap stocks in the US.

Oil declined once again and closed at $60/barrel, predominantly due to strong supply rather than global demand fears. Gold declined to $1210 per troy ounce, while Copper also finished the week lower at $6,078 per metric tonne as recent weakness resurfaced. The 10 year US bond yield was relatively unchanged at 3.18% with midterm election results as expected, while the German equivalent declined to 0.41%. The EUR/USD rate was at 1.134

THE WEEK AHEAD

Wednesday 14th November:

Consumer prices in the US are forecast to rise 0.3% in October. Last month, consumer prices rose 0.1%, below the forecast of 0.2%, with energy prices weighing.

Eurozone GDP estimates released in September pointed to growth of 0.2% q-q and 1.7% y-y. These figures are expected to be reaffirmed in this week’s update.

Thursday 15th November:

Retail sales in the US are forecasted to be 0.4% m-m. They edged up 0.1% in September, below expectations of 0.6%, thanks largely to a drop in spending at restaurants.

[/highlight]

The team at Zurich Investments is a long established and highly experienced team of investment managers who manage approximately €23.5bn in investments of which pension assets amount to €10.8bn. Find out more about Zurich Life’s funds and investments here.

w: zurichlife.ie/funds t: @ZurichLife

l: linkedin.com/company/zurich-life-assurance-plc